JCT Confirms Democrats’ Proposals Increase Taxes on All Americans

Millions of Americans making less than $400,000 per year would see tax hike

Washington, D.C.--A new pair of analyses by the nonpartisan Joint Committee on Taxation (JCT) shows that the Democrats’ latest tax-and-spend provisions under discussion will increase taxes on millions of Americans making less than $400,000 per year, and the average tax rate for every single income category would increase. The JCT previously confirmed that the House-passed Build Back Better Act (H.R. 5376) would result in meaningful tax increases for taxpayers at every income level.

News reports suggest Democrats are prepared to move forward with the full slate of tax increases in the House-passed legislation, without any tax cuts for lower- or middle-income households. JCT estimates that legislation retaining those tax increases, while removing the social policy tax cuts that had been contained in Subtitle G, would provide zero tax relief for the middle class, with the vast majority of Americans seeing tax increases at a time when they can least afford it.

“While Republican tax reform in 2017 cut taxes for all Americans, and increased the progressivity of the tax code, the Democrats’ approach to tax reform does not cut taxes for anyone, but it would raise taxes on millions of lower-and middle-income Americans at a time when they can least afford it,” said U.S. Senate Finance Committee Ranking Member Mike Crapo (R-Idaho). “The economy is already reeling from Democrats’ bad policies and people are struggling to make ends meet. The last thing they need are higher taxes, especially in light of rising odds of a recession and stagflation.”

The first analysis projects the distributional effect of the House-passed tax increases without temporary social policy tax relief. The analysis confirms:

- In 2023, when we are facing the dual threat of inflation and recession, the Democrats would raise $33 billion from Americans earning less than $400,000 per year, while providing a net tax cut of about $1.5 billion for Americans earning more than $400,000 per year.

- Over the course of the 10-year budget window, roughly 30 percent of the revenue raised for spending offsets and deficit reduction would come from Americans earning under $400,000 per year.

- Under the proposal, the average tax rate for every single income category would increase.

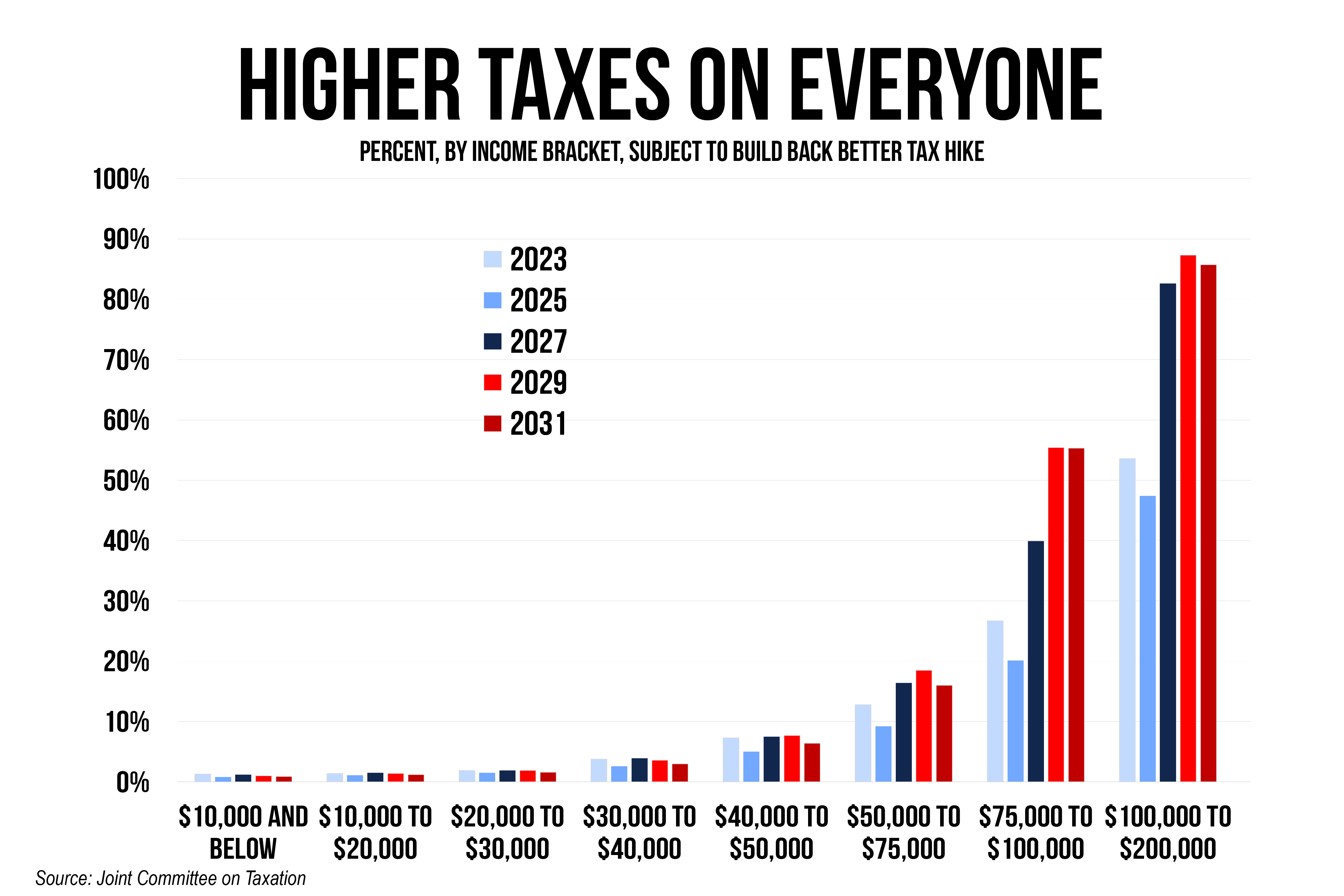

The second analysis projects the tax effect on filers in each income category. The analysis shows:

- If the Democrats’ tax reform is enacted this year, more than a quarter of Americans earning between $75,000 and $100,000 will see a tax increase next year, as will more than half of Americans earning between $100,000 and $200,000.

- In 2023, for taxpayers in the income range of $200,000 to $500,000 (85 percent of whom fall in the $200,000-$400,000 range), more than 80 percent will see a tax hike, reinforcing the fact that these proposals will violate President Biden’s pledge to not raise taxes on anyone earning below $400,000.

- By 2029, nearly 20 percent of Americans earning between $50,000 and $75,000 will get a tax increase, while none will receive tax relief.

The analyses do not include a repeal of the state and local tax (SALT) cap. Past analyses from the Tax Foundation, Committee for a Responsible Federal Budget and others have shown that the net effect would essentially wipe out any tax hit on the wealthy, leaving the middle class to shoulder even more of the brunt of the tax burden in their bill.

Next Article Previous Article