Press Contact:

Katie Niederee and Julia Lawless, 202-224-4515

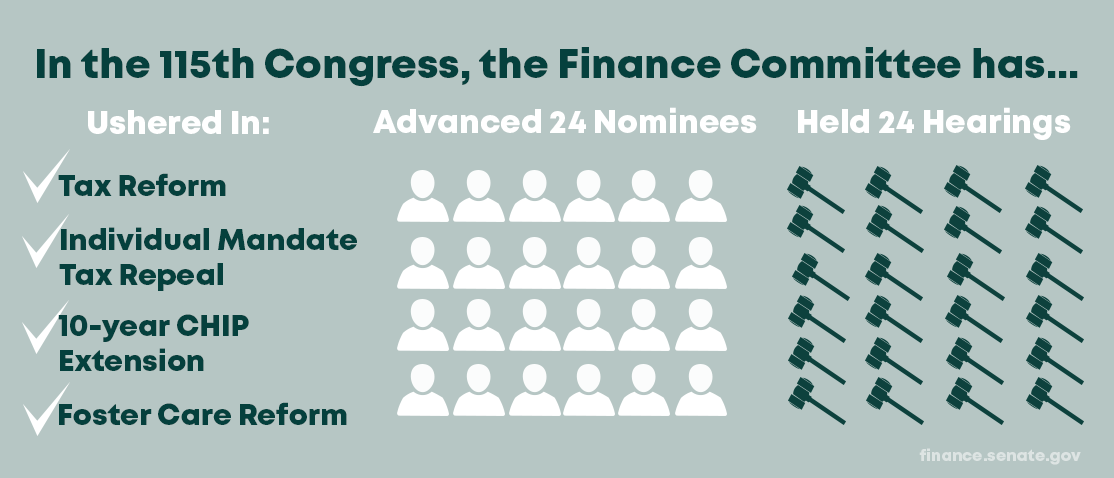

Victories Abound for Senate Finance Committee

Committee Amasses Legislative Wins, Convenes Hearings, and Clears Nominees Throughout 115th Congress

The Senate Finance Committee has been busy, very busy, throughout the 115th Congress. With a new Republican administration, the committee under the leadership of Chairman Orrin Hatch (R-Utah), spearheaded the biggest tax overhaul in more than 30 years, chipped away at Obamacare, secured bipartisan health care accomplishments, and it’s showing no signs of slowing down any time soon.

Take a look at what the committee has been up to:

Major Legislative Victories

Chairman Hatch worked with members to secure a number of legislative achievements throughout this Congress that run the spectrum of the Finance Committee’s jurisdiction, the largest of any committee in either chamber of Congress.

Here are some highlights:

Tax Reform: Hatch authored a comprehensive tax overhaul that provided middle-class tax cuts, relief for Main Street businesses and modernized the international side of the code to keep America competitive. Just six months into the new tax code, we are already seeing the lowest unemployment rate in nearly two decades and record business optimism.

Individual Mandate Repeal: The Finance Committee opted to include a provision in the tax overhaul that effectively repeals the onerous and regressive individual mandate that disproportionally hit low-income Americans.

10-year CHIP Extension: Hatch created the Children’s Health Insurance Program (CHIP) with former Sen. Ted Kennedy (D-Mass.) more than two decades ago. The program, which bridges the gap for families who don’t qualify for programs like Medicaid but still cannot afford private insurance, is successful and financially responsible, and continues to receive bipartisan support. Earlier this year, Hatch fought for CHIP to be extended for 10 years, the longest extension in the program’s history.

Foster Care Reform: Hatch, as a co-author of the Family First Prevention Services Act ,had the measure included in the bipartisan budget deal earlier this year. The new law will help keep more children safely with their families instead of placing them in foster care.

CHRONIC Care Act: Hatch worked to pass the Creating High-Quality Results and Outcomes Necessary to Improve Chronic (CHRONIC) Care Act of 2017, which will improve health outcomes for Medicare beneficiaries living with chronic conditions while lowering Medicare costs and streamlining care coordination services in a fiscally sound manner. The legislation is a result of a committee-wide effort that included a bipartisan working group, stakeholder feedback and hearings.

More information about Hatch’s legislative wins at Finance can be found here.

24 Hearings

The Finance Committee has held 24 hearings so far in the 115th Congress, ranging from drug affordability and innovation earlier this week to the administration’s use of 232 tariffs and the harms of counterfeit products in e-commerce. Whether it’s conducting oversight or exploring policy solutions, hearings play a critical role in driving the committee’s work.

Earlier this month, the committee advanced legislation aimed at addressing the nation’s opioid crisis by making much-needed reforms to Medicare, Medicaid and family services programs.

24 Nominee Advancements

A new administration needs a fully-staffed executive branch to enforce the laws enacted by Congress, as well as issue regulatory guidance and effectively implement existing programs. The Senate Finance Committee has held 16 nomination hearings and has reported out 24 of President Trump’s nominees. Just this week, the committee held a hearing to consider Charles Rettig’s nomination to be the Internal Revenue Service (IRS) Commissioner and advanced the nominations of Jeffrey Kessler to be an Assistant Secretary of Commerce, Lynn A. Johnson to be Department of Health and Human Services Assistant Secretary for Family Support, Elizabeth Ann Copeland to be a United States Tax Court Judge, and Patrick J. Urda to be a United States Tax Court Judge.

###

Next Article Previous Article