History

- Origin 1789-1816

- The Early Years 1817-1861

- The Civil War 1861-1865

- The Gilded Age 1866-1900

- The Progressive Era 1900-1912

- World War I 1913-1932

- The Great Depression 1932-1938

- America at War 1939-1945

- The Postwar Boom 1946-1959

- Entitlement and Tax Reform 1960-1969

- The Modern Finance Committee 1970-Present

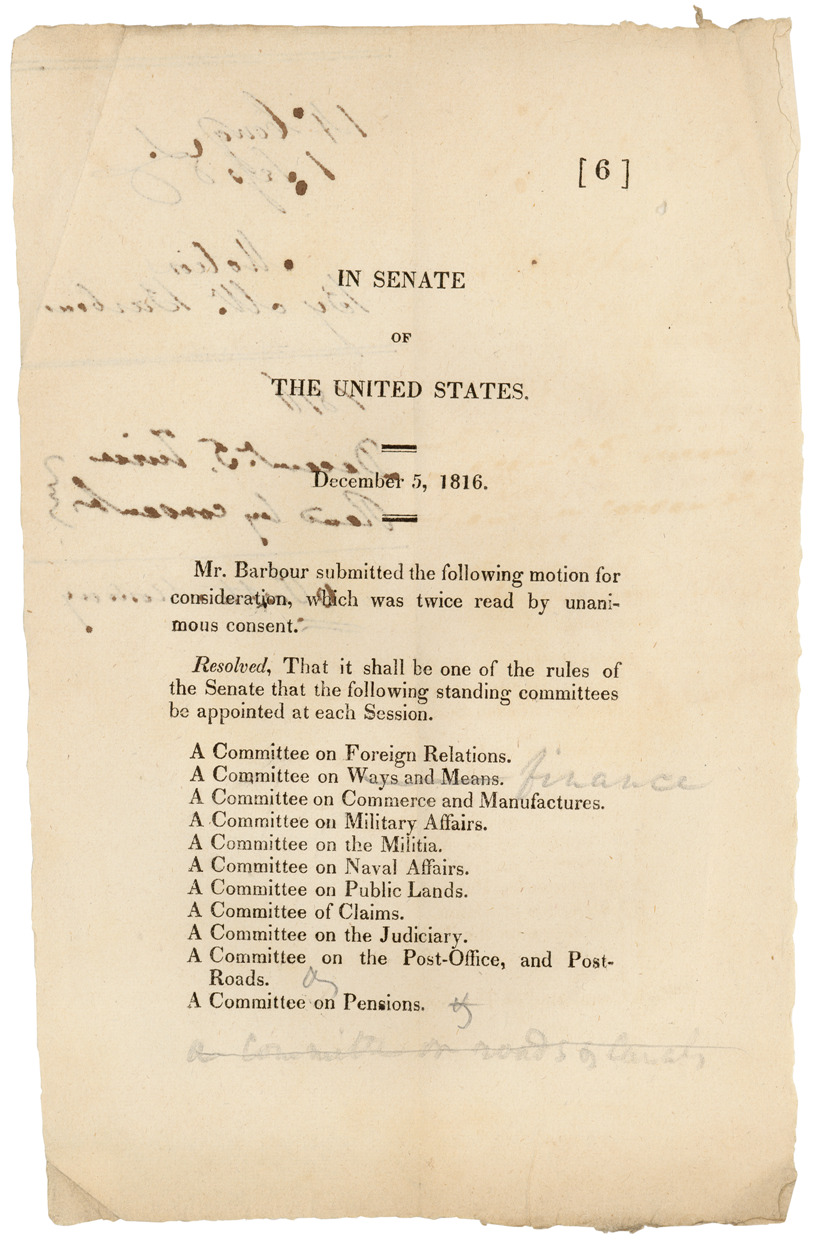

Origin (1789-1816)

During the Senate's first 27 years, it had no standing committees. The early Senate was a small body. It conducted its work through temporary committees that met as needed and disbanded when the Senate enacted the legislation that had prompted the Senate to form the committee.

To address problems that arose from this system, the Senate adopted a rule to create select committees to which the presiding officer referred similar pieces of legislation. This rule resulted in the forerunner of the Finance Committee. During the 14th Congress (1815-1817), the Senate created the Select Committee on Finance and an (sic) Uniform National Currency. The Senate formed the Committee to handle some of the proposals set forth in President James Madison's message to Congress.

The Select Committee went on successfully to address two major issues of the Congress — the Tariff Act of 1816 and the Bank Act. The Tariff Act eliminated some of the debt that the nation had accumulated as a result of the War of 1812. The Bank Act stabilized the nation's chaotic financial system.

In 1816, in the second session of the 14th Congress, the Senate formalized the committee structure. Senator James Barbour of Virginia offered a motion to establish specific standing committees as part of the Senate's rules. The Senate adopted Senator Barbour's motion and on December 10, 1816, established the Committee on Finance as a standing committee of the Senate. Three days later, its first Members were appointed: Senators George Campbell of Tennessee (the Committee's first Chairman), Jeremiah Mason of New Hampshire, Thomas Thompson of New Hampshire, Rufus King of New York, and George Troup of Georgia. Back to Top

The Committee's Early Years (1817-1861)

While the Select Committee on Finance and an (sic) Uniform National Currency had passed the Tariff Act of 1816, it would be years before its successor could claim full jurisdiction over tariff legislation. The Finance Committee shared jurisdiction over tariffs with the Committee on Commerce and Manufacturers. Senators on the Commerce and Manufacturers Committee tended to be more protectionist, as the nation strove to foster its emerging industry. And the Senate steered most tariff legislation to the Commerce and Manufacturers Committee.

Senators on the Finance Committee made many attempts to get tariff legislation referred to the Finance Committee. They argued that tariffs were a means to raise revenue, and revenue was within the Finance Committee's jurisdiction. But every attempt to refer tariff bills to the Finance Committee failed, as more parochial concerns over protecting the industries of particular Senators' states resulted in the Senate referring legislation to the Commerce and Manufacturers Committee.

As years passed, tariff issues grew larger, exposing a geographic division in the country. Southern and western interests supported reductions in tariffs. Northern interests, however, felt that tariffs were still too low and did not afford enough protection.

By 1833, disputes over tariffs reached a crisis. South Carolina threatened to nullify all tariff acts. The Senate was forced to act. And Henry Clay offered a solution that would draw down tariffs over a 10-year period. Congress passed the bill, and President Jackson signed it into law.

The new law calmed the sectional tensions that the tariff issue had raised. And it also helped to solidify the Finance Committee's jurisdiction over trade matters. A specially-crafted select committee had approved the bill, allowing the Senate to bypass the protectionist Commerce and Manufacturers Committee. This move away from the Commerce and Manufacturers Committee allowed the Finance Committee to begin to claim the tariff jurisdiction. By the next major tariff revision, in 1842, the Finance Committee's claim of authority over tariff legislation was complete.

The tariff issue was not the only major task that the Finance Committee had to handle in its early years. By 1830, a battle was brewing over renewing the charter of the Second Bank of the United States, which the Committee had helped create in 1816. During his Presidential campaign, President Andrew Jackson argued that the Second Bank had outsized influence on the nation's currency and financial system and violated the Constitution.

The Finance Committee, under the leadership of Chairman Samuel Smith, held a series of hearings on the bank. The Committee determined that the bank created a sound and uniform currency in the United States.

Senator Daniel Webster led the defense of the bank in the Senate, with the support of Senator Henry Clay. They successfully maneuvered a bank bill through Senate passage to an expected veto by President Jackson, believing that they could convince enough Senators to override the veto. But the bank's supporters failed to garner the two-thirds vote to override. President Jackson won reelection in the fall and set about his plans to kill the Second Bank of the United States.

President Jackson ordered the Secretary of the Treasury to remove all Federally-held deposits from the bank and to distribute them to individual state banks. The President of the Second Bank, Nicholas Biddle, retaliated by curtailing loans and the issuance of the bank's notes. This hurt smaller banks and contributed to an economic panic and depression.

Senators Webster and Clay united to fight what they saw as President Jackson's unconstitutional acts. Webster took the Finance Committee chairmanship and issued a report finding that only Congress had the authority to remove Federal deposits from the bank. Meanwhile, Clay introduced resolutions of censure against President Jackson and Treasury Secretary Roger Taney for their actions in removing the deposits. The Finance Committee reported the resolutions. And Clay helped shepherd them through the Senate.

The censure of President Jackson and the Treasury Secretary stood for 3 years. Every year, Senator Thomas Hart Benton offered resolutions to have them stricken from the record. Finally, in 1837, Democrats secured control of the Senate. And in a crowded ceremony on the Senate floor, they took a pen and crossed out the censure from the Senate Journal. Henry Clay, now in the minority, lamented that “the Senate is no longer a place for any decent man.” Back to Top

The Civil War (1861-1865)

When the Civil War broke out, the Finance Committee had jurisdiction over appropriations, revenue, and the nation's currency. As a result, the Committee played a critical role during the war. After the shelling of Fort Sumter and the First Battle of Bull Run, President Abraham Lincoln called Congress into a special session. Congress promptly passed an expanded tariff bill and a loan bill to raise revenue.

During this special session, the Committee first addressed the issue of an income tax to fund the war. The tariff bill passed by the House of Representatives was referred to the Finance Committee. With the leadership of Senator Furnifold Simmons of Rhode Island, the Committee changed the direct taxes in the bill to income taxes. The income tax provision survived the Senate floor and conference with the House to be signed into law. But Treasury Secretary Salmon Chase refused to administer the new tax, hoping that loans and tariffs would be enough to support the war effort.

By 1862, it was apparent that government loans had not raised the revenue needed to fund the war effort. As well, the war hindered trade, decreasing tariff revenues. Meanwhile, state banks were refusing to buy government securities. And citizens and banks began to hoard gold. Secretary Chase made it known that he was open to any ideas to end the financial crisis. Congress proposed a radical solution.

The House Ways and Means Committee adopted a proposal to create the nation's first non-interest-bearing paper currency that would be “lawful money and legal tender in payment of all debts, public and private, within the United States.” Secretary Chase opposed the legislation, fearing that it would spark inflation and a rash of counterfeiting. Chase's efforts to defeat the bill divided the Finance Committee.

Chairman William Fessenden supported most of the bill. But he opposed the legal tender language, declaring it “a confession of bankruptcy.” Senator John Sherman, however, favored the House-passed bill and worked to shepherd it through the Senate. Senator Sherman worked out a compromise with Chairman Fessenden to allow the loan payments within the bill to be backed by hard currency. Congress passed the measure, and President Lincoln signed it into law.

The currency, called the “greenback” because of its color, made its way into circulation. The Government printed an additional $150 million in 1862. And 2 years later, Congress authorized another $150 million. The Legal Tender Act of 1862 was the first occasion in which the Government conducted its transactions in paper rather than through gold or silver. The Act also established the precedent of paper currency backed by the full faith and credit of the Federal Government rather than gold or silver. Greenbacks continued to be the legal tender of the United States until they were replaced by Federal Reserve Notes in 1971.

By 1862, Congress could see that the war would last a number of years. In response, Congress moved away from further increases in tariff rates, turning instead to income taxes to fund the war. House legislation incorporated direct taxes in addition to the flat income tax rates. When Chairman Fessenden reported the bill to the Senate, he noted that he was the only one among the Committee's Senators who cared for the House's direct tax provisions. The Senate struck the direct taxes and substituted progressive income tax rates to recoup the lost revenue.

Under the new law, incomes of less than $600 a year were not taxed. The law taxed incomes from $600 to $10,000 at 3 percent, incomes from $10,000 to $50,000 at 5 percent, and incomes over $50,000 at 7.5 percent. Congress raised the rates in 1864 and 1865.

On the spending side of the nation's fiscal policy, the Finance Committee addressed expenses of the Federal Government from military expenditures to general appropriations for roads and public buildings. In 1861, the expenses of the Federal Government were $66 million. In 1862, the war caused Federal Government expenses to rise sevenfold, to $474 million. And outlays rose steadily thereafter to $715 million in 1863, to $865 million in 1864, and to more than a billion dollars in 1865.

By the end of the war, it was apparent that the Finance Committee's work had become too much for a single committee. In March 1867, the Senate adopted without dissent a resolution to modify the Senate rules to create a new Committee on Appropriations to relieve the Finance Committee of its responsibility for appropriation measures. Back to Top

The Gilded Age (1866-1900)

At the conclusion of the Civil War, the Finance Committee had much to do to stave off economic depression. The Committee had to consider whether to continue the economic policies that had sustained the Union during the war.

The greenbacks created during the Civil War had proved popular. The notes were easier to obtain than gold coins. Congress enacted legislation to limit the amount of greenbacks in circulation to $356 million, the amount in circulation in 1868. The law provided that the Government could print no greenbacks beyond that amount.

Finance Committee Senators were concerned about reducing the greenbacks' role in the nation's currency supply because of the size of the national debt. A month after Lee's surrender at Appomattox, the national debt stood at $2.3 billion dollars. Incoming Finance Committee Chairman John Sherman knew that once hostilities ended and the process of reconciliation began, Americans would call for a reduction of the taxes that had been levied on the Union to finance the war. And many began to question the constitutionality of income taxes. In response, Congress gradually reduced the income tax until it was repealed in 1872.

In 1873, the Finance Committee reported the Coinage Act. The legislation would affect numerous interests, spark what came to be called the Silver Wars, fracture both political parties, and help to foster the Populist Party.

Before the Coinage Act, the United States relied on both gold and silver coins as currency. Anyone mining gold or silver in quantity could bring the metal to their local mint to be coined, and be paid in either the minted coin or the money equivalent in gold. But large finds of silver, such as the Comstock Lode, as well as the change that many European countries were making to the Gold Standard made apparent that maintaining the free coinage of silver would result in a financial strain on the Treasury.

The Coinage Act solved the problem by charging a fee of those seeking to have their silver minted. The fee did not apply to those who brought in gold to be minted. The Coinage Act also reorganized the Mint under the Treasury Department, creating it as its own bureau, where it still resides today.

Many in western states, where silver deposits lay, opposed the law. Opponents of the measure called it the “Crime of ‘73” and used it as a rallying point against the special interests that they saw controlling Congress.

In 1877, western Members of Congress forced action on the silver issue, seeking a resumption of the free coinage of silver. Without debate, on a lopsided vote of 163 to 34, the House of Representatives passed a measure to restore the free coinage of silver. The Finance Committee removed the free coinage provision, and instead required the Federal Government to buy $2 million to $4 million of silver each month. The Senate voted 47 to 22 to adopt the Finance Committee amendment. Congress overrode President Hayes' veto to enact the resulting Bland-Allison bill into law. As the Hayes Administration disapproved of the law, the Government purchased only the $2 million minimum monthly amount. The Bland-Allison Act cooled the burgeoning silver wars for nearly a dozen years.

By 1890, the silver issue was once again in the nation's headlines. Since the passage of the Bland-Allison Act, the price of silver had declined from $1.20 an ounce to 6 cents an ounce. Silver interests demanded that the Federal Government purchase more than $2 million of silver a month. And Congress responded with the Sherman Silver Purchase Act. The Act still did not allow for the free coinage of silver. But it required the Federal Government to purchase $4.5 million of silver every month, an amount nearly equal to the amount mined in western states. The Sherman Silver Purchase Act ended the long battle over the silver issue.

Three years later, during the Panic of 1893, Congress repealed the Sherman Silver Purchase Act in an effort to stabilize the nation's currency. By the end of the decade, the nation adopted the gold standard, pegging the value of its currency to a fixed weight of gold.

The Democratic Party regained control of Congress in 1893. Democrats argued that tariff rates were too high and protected special interests. So in addition to repealing the Sherman Silver Purchase Act, the new Democratic Congress reduced tariff rates with the Wilson-Gorman Tariff Act of 1894. The Act also included an attempt to reinstate a Federal income tax, which Democrats argued was Constitutional. The Act's income tax rates sparked a raucous debate in both chambers of Congress, with charges of sectionalism and class warfare.

Soon after passage, plaintiffs filed three suits challenging the constitutionality of the law. The Supreme Court's initial ruling left both sides dissatisfied. The Court was unable to rule broadly on the constitutionality of the law, and instead struck down minor taxes on rents and interest on municipal bonds.

Illness forced Justice Howell Jackson to miss these arguments. But in a second hearing of the case, Jackson was in attendance, heartening supporters of the income tax, who expected him to support the tax's constitutionality. Twelve days after the final hearing, the Court returned with its decision. The Court's 5-4 decision in Pollock v Farmers' Loan and Trust Company stunned supporters of the tax, holding income taxes unconstitutional.

The majority extended the line of reasoning from the Court's previous decision on rent taxes. The Court held that an income tax was a tax on personal property by reason of its ownership and therefore a direct tax. As it was not levied based upon apportionment, it was invalid. The Court's decision appeared likely to kill efforts to raise revenue through income taxes. Back to Top

The Progressive Era (1900-1912)

By the end of the first decade of the 20th Century, support for a revised income tax had grown in both political parties. Most of these progressives were Democrats, but they had allies among a small group of mostly western Republicans led in the Senate by Senator Robert La Follette of Wisconsin and Senator Jonathan Dolliver of Iowa. These progressive Republican Senators would become known as the “insurgents.”

At that time, Republican Nelson Aldrich of Rhode Island chaired the Finance Committee. Aldrich sought to further protect industries in his home state, proposing in 1909 to further increase tariffs. To assure passage in the Senate, Aldrich placed enough incentives into the bill for a majority of Senators on both sides of the aisle to support the bill, all while maintaining high tariff rates and no new internal taxes.

Chairman Aldrich ran into opposition, however, from the progressive Republicans, who allied themselves with Democrats to keep tariffs low. The progressive coalition hoped to derail the bill by adding the income tax through an amendment. Aldrich twice fended off consideration of the amendment on the floor, as he worked furiously to assemble enough votes to kill the amendment outright. Aldrich met with President William Howard Taft, Senator Henry Cabot Lodge, and Senator Winthrop Crane at the White House, working unsuccessfully to craft a wedge that would split the Democrats from their newfound progressive Republican allies.

The debate raged on for another month as Aldrich's supporters lambasted the proposed amendment on the Senate floor. Meanwhile, President Taft, at the behest of the Chairman, urged eastern Senators to come out against the amendment. After two months, Chairman Aldrich saw that his only hope for passage of the bill lay in giving the progressive forces something that they wanted. Aldrich offered to include a tax on corporations, and offered to allow a vote on a proposed Constitutional Amendment on income taxes. Once he nailed down this compromise, Chairman Aldrich secured passage of the tariff act.

Following through on the agreement, President Taft sent Congress a joint resolution proposing a Constitutional Amendment for an income tax. Senator Norris Brown of Oklahoma introduced the resolution in the Senate. The proposed text read: “The Congress shall have the power to lay and collect direct taxes on incomes without apportionment among the several states according to population.”

The joint resolution was referred to the Finance Committee. The Committee proposed an amendment to strike the word “direct” and add the phrase “from whatever source derived” after the word “incomes.” Minnesota Senator Knute Nelson, a Member of the Judiciary Committee, suggested this change to Chairman Aldrich to allow the Federal Government to include incomes from state and municipal securities as well as incomes from fortunes consisting of invested capital. On the Senate floor, the resolution survived a few attempts to alter it. And the Senate passed it by a vote of 77 to 0 on July 12, 1909.

The debate moved to the House of Representatives. Ways and Means Chairman Sereno Payne opposed the bill, but saw the inevitability of its passage. The Constitutional amendment passed the House 318 to 14.

Thirty-six states needed to ratify the new amendment for it to become part of the Constitution. A month after congressional passage, Alabama became the first state to ratify the amendment. The following year, eight more states ratified. Twenty-five more followed in the next 2 years. On February 3, 1913, New Mexico became the 36th state to ratify the amendment. In all, 42 states ratified what would become the 16th Amendment. On February 25, 1913, Secretary of State Philander Knox certified that the 16th Amendment had become a part of the Constitution.

In the 1912 elections, a split in the Republican Party enabled the Democrats to gain control of the Senate for the first time in 2 decades. To address the demands of varied interests within the Democratic Party, the Democratic leadership divided the jurisdictions of several committees. After considerable negotiations, the Democratic leadership decided to take from the Finance Committee its banking and currency functions and to create a new Committee on Banking and Currency.

After the states ratified the16th Amendment, Congress promptly enacted an income tax. Passed as a part of the Underwood-Simmons Tariff Act of 1913, the first peacetime income tax affected only 2 percent of the workforce. Though widely hailed, the tax was subject to two court challenges in 1916. In both cases, the Supreme Court decided that the Federal Government had the right to collect income taxes. Back to Top

World War I Era (1913-1932)

With the outbreak of World War I in Europe, imports into the United States declined steeply in 1914. The loss of tariff revenue forced President Woodrow Wilson to call for Congress to raise an additional $100 million in revenue through internal taxes. Throughout the next few years, Congress would continue to seek new sources of revenue. Congress created a permanent estate tax, surtaxes on income, and a war-profits tax on corporations. By the end of President Wilson's term, incomes higher than $1 million were subject to a total tax — both income and surtax — of up to 77 percent.

By the conclusion of World War I, the revenue-generating policies of the nation had dramatically changed. Prior to the war, tariffs and excise taxes had supplied more than 90 percent of Federal revenues. After the war, income taxes generated 58 percent of Federal revenues. The income taxes proved necessary, as Federal expenditures during World War I exceeded those of any prior war. With World War I, annual Federal spending increased 2,459 percent, from $742 million to $18.9 billion.

With the conclusion of the war and a new Republican President and Congress, Federal tax rates gradually declined throughout the 1920s. To replace the lost revenue, Congress increased tariffs.

The 1926 Revenue Act also created a joint committee to assist Congress in writing tax laws. The House had initially envisioned a Joint Commission comprised of five Representatives, five Senators, and five members chosen by the President. The Senate amended the bill by excising the Presidential appointments. The product, Congress' first joint committee, was named the Joint Committee on Internal Revenue Taxation.

In 1917, the War Risk Insurance Act expanded the Finance Committee's jurisdiction to include certain veterans' legislation. Previously, the Senate Committee on Pensions had controlled veterans' legislation. Some believed that the War Risk Insurance Act represented a new principle in veterans' benefits. They therefore felt that the Senate should keep the new system separate from the existing pension system. Congress placed its administration within the Treasury Department, over which the Finance Committee maintained nearly complete jurisdiction. Thereafter, most veterans' legislation passed through the Finance Committee.

The War Risk Insurance Act established a new benefit system to provide aid to members of the armed services and their families both during and after service. The Act also created new vocational rehabilitation benefits to return disabled veterans to gainful employment. And a system of wartime allotments and allowances to dependents of servicemen was instituted so that soldiers' dependents would not be in need while they were away.

The Finance Committee continued to work on veterans' benefits, passing a “Bonus Bill” for World War I veterans who had not suffered disabilities during the war. The bill would compensate them for their service and loss of wages. Congress passed the legislation numerous times, and several Presidents vetoed it. Congress finally overrode President Calvin Coolidge's veto to enact it into law.

The Roaring Twenties came to an abrupt end on October 24, 1929, with the stock market crash. President Herbert Hoover and Congress took months to respond, and when they did, they enacted the ill-fated Smoot-Hawley Tariff Act. President Hoover hoped that a revision of the tariff laws would jump-start business in the United States and protect them from cheap foreign competition. Chairmen Willis Hawley of the Ways and Means Committee and Reed Smoot of the Finance Committee worked to completely revise all the tariff rates. The new law resulted in an extraordinary decrease in world trade. American exports fell from $488 million to $120 million, and imports fell from $368 million to $96 million. Back to Top

The Great Depression (1932-1938)

In 1933, President Franklin Delano Roosevelt was in the White House and the Democrats had ridden his coattails to take over the House and Senate. During President Roosevelt's first 100 days, the Finance Committee passed the Economy Bill, which granted the President the authority to slash Federal spending by 25 percent. The Act cut the Federal workforce by 15 percent and reduced all veterans' benefits. The savings from the Act totaled $500 million and supported President Roosevelt's effort to carry out his campaign promise to balance the budget without an income tax increase.

To raise revenue quickly, the Finance Committee next turned its attention to a liquor tax. The Cullen-Harrison Act legalized and then taxed beer with an alcohol content of less than 3.2 percent. Any beer with more than 3.2 percent alcohol was still illegal under Prohibition. Chairman Pat Harrison promised quick action on the bill when he assumed the chairmanship of the Finance Committee. The Committee followed suit by passing the bill in a day, without a roll call vote.

The following year, Congress turned its attention to the disastrous Smoot-Hawley Tariff. President Roosevelt tapped his Secretary of State Cordell Hull to craft a new trade program. Hull, who had previously served on the Finance Committee, recommended that the executive branch be granted authority to negotiate and promulgate reciprocal trade agreements. Secretary Hull felt that this was the only way to lower tariffs while avoiding the time-consuming process of traditional tariff revisions, which invited special interests to push for higher tariffs. Hull's proposal to craft executive agreements, as opposed to treaties, allowed the Senate to implement those agreements with a simple majority vote rather than the supermajority vote required to ratify a treaty.

The Reciprocal Trade Agreements Act of 1934 marked the end of major congressionally-sponsored tariff bills. The Act vested that responsibility with the executive branch. And the Roosevelt Administration then negotiated trade agreements with Canada, Argentina, Britain, and other nations.

Congress limited the Act to 3 years, partially to assuage those who feared giving the President too much power, and partially to see how the experiment in trade policy would work. The 3-year limit made the Act a temporary arrangement that could always be allowed to lapse, should Congress so choose.

As well, the Act expanded Finance Committee jurisdiction. Now the Committee handled not only tariffs, but also a broad range of trade policies that would arise from trade agreements.

Soon after President Roosevelt signed the Reciprocal Trade Agreements Act into law, he established the Committee on Economic Security to examine and recommend proposals to promote greater economic security for Americans. The Committee's task was to design a Federal social insurance program for the elderly and the unemployed. In January of 1935, the Committee reported its recommendations to the President, and he submitted them to Congress.

The House and Senate held simultaneous hearings on the bill. The Ways and Means Committee redrafted the measure and changed its title to the Social Security Act. The House passed the measure on a 373 to 33 vote.

According to participants, the Finance Committee process was more orderly than its House counterpart. Chairman Pat Harrison remained in constant control. If Chairman Harrison was uncertain of victory on an amendment, he would delay a vote until he was sure that his view would prevail. Chairman Harrison used this procedure on the most controversial of measures, such as Senator Bennett Clark's amendment to allow employers with preexisting pension plans to opt out of the new system.

The Committee made a number of changes to the Social Security bill, including reinstating voluntary annuities by a single vote during a time of slim attendance. To lower costs, the Committee required beneficiaries to cease work in order to receive benefits. The Committee also added a new title for annual allotments to states for aid to the permanently blind. On the last day of deliberations, the Clark Amendment to allow employers to opt out failed on a 5-to-5 tie vote, after the Chairman had waited for a number of Senators who supported the amendment to be absent. The Committee reported the bill with a voice vote on May 20. Within in a month, Chairman Harrison had secured Senate passage with only six Senators voting against the bill.

The conference committee lasted throughout July. The major stumbling block was the Clark Amendment, which the House refused to accept. In the end, Senator Clark accepted his amendment's defeat with the understanding that his amendment would be studied by a joint committee in the next session of Congress (where it eventually languished). The conference committee reported the completed Social Security bill, which the House and Senate quickly passed and President Roosevelt signed into law on August 14, 1935.

The Social Security Act was revolutionary in its benefits, revenue generation, and effect on the Finance Committee. The Act provided unemployment insurance, aid to dependent children, and benefits to the elderly who met certain qualifications.

Social Security payroll taxes were also innovative. They affected both employers and employees, in an attempt to make caring for the elderly a national responsibility. The Finance Committee maintained its jurisdiction not only over the new payroll taxes that funded the program, but also over all the programmatic elements of the Act. Welfare, old age insurance, unemployment insurance, and every new program in the Social Security Act would remain within the Committee's jurisdiction. Back to Top

America at War (1939-1945)

By 1941, Germany had conquered most of Europe and had begun its bombing campaign against Britain. And the Japanese had joined the Axis powers. Meanwhile, in the United States, the boom in the defense industry had helped bring the country out of the Great Depression.

The Finance Committee had the responsibility to raise revenue to pay for the buildup. The result was some of the largest revenue measures in the nation's history, affecting all Americans. By early 1942, the Federal Government was spending $150 million a day, or roughly $5 billion a month, with nearly half of this total going towards the war effort.

One of the novel revenue-generating measures that the Finance Committee introduced in the Revenue Act of 1942 was the “Victory Tax.” At 5 percent, the tax applied to every American, and came in addition to the normal taxes and surtaxes on all incomes over $624. The Revenue Act of 1942 was estimated to provide the Federal Government with an additional $7 billion in new revenue. This would provide more revenue than the entire system had provided in any year before1941. The underlying Revenue Act swelled the nation's tax rolls to 37 million taxpayers, compared to just 2 million taxpayers in 1932. And the Victory Tax increased the rolls further to 50 million taxpayers.

The next year, the Roosevelt Administration asked for a tax increase to curb inflation. Prices had risen by 25 percent since 1941. The House and Senate reluctantly agreed to a minor tax increase. But this was not enough for President Roosevelt, who became the first President to veto a revenue measure.

The veto met a hostile reaction in both chambers of Congress. Chairman Walter George retorted that there was such a thing as “too much taxes.” An incensed Congress swiftly overrode the veto, making the Revenue Act of 1943 the first revenue act to become law over a President's veto.

As the Allies began the march toward victory, the Finance Committee turned its attention to the nation's returning veterans and what would become the G.I. Bill of Rights. Congress knew that it would have to help returning veterans and help bring the nation back to a peacetime economy.

In the Finance Committee, Senator Bennett “Champ” Clark relied on veterans' organizations such as the American Legion to craft a bill. Clark's bill met opposition from other veterans' organizations, and President Roosevelt was uncommitted. Working quietly on the bill, Senator Clark secured the co-sponsorship of 81 senators. During Senate floor debate, Senators not listed as co-sponsors clamored to the floor to express their indignation over Clark's not having listed them as co-sponsors. After a few days of minimal debate, the Senate passed the bill unanimously 50-0, with 46 Senators absent.

House debate was more contentious. Congressman John Rankin, Chairman of the World War Veterans' Legislation Committee, saw the bill as the last gasp of a New Deal that he vigorously opposed. He saw the educational benefits as a violation of states' rights and an attempt to create bastions of liberalism. And he opposed the readjustment allowances in the bill — which offered 52 weeks of unemployment benefits, at $20 a week, to returning veterans unable to find a job — calling it a reward for men to sit around for a year to do nothing.

Despite Rankin's reservations, the House passed bill, and it went to a conference committee on June 8, 1944. The conference committee got down to business as allied forces were breaking out of their beachheads in Normandy. Conferees quickly worked out most of the issues dividing the Senate and House. But the unemployment provisions remained a sticking point.

The Senate refused to back down. And Chairman Rankin refused to vote the proxy of Representative John Gibson of Georgia, who supported the measure. Congressman Gibson made a midnight sprint from Georgia to Washington to cast his vote for the Senate unemployment provisions and resolve the issue.

The G.I. Bill of Rights provided nearly 8 million veterans with additional educational or professional training after World War II. Another 4 million took advantage of the generous home loan guaranty benefits in the Act. Only about 5 million veterans ever received unemployment benefits, and the vast majority did so for only about 18 weeks. The G.I. Bill of Rights was a resoundingly success and served as a forerunner of other benefits in subsequent years. Back to Top

The Postwar Boom (1946-1959)

As the nation emerged from World War II, Congress reorganized its committee structure for the postwar world. Senator Robert La Follette Jr., who also served as Ranking Member of the Finance Committee, headed a Special Committee on the Organization of Congress. His committee's June 1946 report proposed to alter the Finance Committee's jurisdiction in a number of ways. The report proposed to shift jurisdiction of Social Security legislation, aside from tax aspects, to the Committee on Labor and Public Welfare. Additionally, the report proposed to shift the Finance Committee's jurisdiction over veterans' affairs to a newly created Committee on Veteran's Affairs.

Finance Committee Chairman Walter George made certain to be on the floor when debate on the bill began. Chairman George noted that the bill would cut off the one committee designed to raise money from any “actual relation or control or even the opportunity to influence the expenditure of money.” He contended that if the bill was passed as it was, then the Finance Committee “might as well be abolished.” Senator George said that should the Senate try to act quickly on the bill he would be forced to filibuster. His arguments won the day, and the Finance Committee survived the committee reorganization intact.

Soon after the conclusion of the war, Republicans gained control of Congress and tried to lower the high tax rates that had funded the war. But President Harry Truman vetoed the tax-cutting legislation, preferring to retire wartime debt. By 1948, however, the Government was running a surplus of more than $6 billion. And the President was forced to accept legislation that cut taxes for all income brackets.

Then, in the first comprehensive examination of Federal income taxes since their creation in 1913, Congress and the executive branch studied 50 major areas of tax legislation. The resulting legislation, the Internal Revenue Code of 1954, made a number of changes. Among the new provisions were deductions for child care expenses and exclusion from taxation of combat pay and employer contributions to health plans. Back to Top

Entitlement and Tax Reform (1960-1969)

At the beginning of the 1960s, a new Democratic President took office. President John F. Kennedy's main efforts focused on welfare reform, a major revision of trade legislation, and an expansion of the nation's health care system.

By the mid-1950s, the Aid to Families with Dependent Children program was in need of revision. When it was created as a part of Social Security, its main beneficiaries were widows. But by the late 1950s, fewer than 15 percent of beneficiaries were widows. The President's welfare reform plan placed more of an emphasis on prevention and rehabilitation in an effort to help people rise on their own, rather than stay on the public rolls. The legislation thinned the numbers on welfare.

With welfare reform completed, the Finance Committee moved to reform the nation's trade laws. A number of extensions were made during the 1950's to keep trade agreements open with other countries. But President Kennedy wanted to dramatically lower tariffs and establish new agreements with other nations during the next meeting of the General Agreement on Tariffs and Trade, or GATT.

The Trade Expansion Act allowed the President to slash tariffs by as much as 50 percent, and allowed across-the-board (instead of item-by-item) tariff rate cuts. The law also implemented a new policy that would assist American workers who lost their jobs as a result of imports. The Trade Adjustment Assistance program provided loans to employers for diversifying and modernizing their plants, while providing extended unemployment benefits and retraining for displaced workers.

By the mid 1960s, President Lyndon Johnson was in office and was attempting to complete the late President Kennedy's goal of providing health insurance for the nation's elderly and poor. President Johnson used all of his formidable legislative skills to usher the Social Security Act of 1965 to passage.

In the House, the President allowed congressional leaders to meld their proposals with his administration's plan. Congress failed to enact the President's proposal of having Medicare cover the costs of prescription drugs. And the Ways and Means Committee increased the associated taxes to accommodate the cost associated with the new Medicare program.

By the time the legislation came over to the Senate, the President had already been hard at work convincing Finance Committee Chairman Harry Byrd to allow the bill to move through the Committee. Chairman Byrd's health was failing, and he was in the last days of his chairmanship when the bill came before the Committee. As a more conservative Democrat from Virginia, Byrd was not considered a reliable supporter of President Johnson's Great Society legislation.

President Johnson helped to ensure his support by inviting the Chairman to a medal ceremony for astronauts Gus Grissom and John Young. After the ceremony, the President and the Chairman moved to another room, where a press conference was held. The press asked Chairman Byrd about the prospects for the Medicare bill. Put on the spot, the Chairman agreed that the bill would receive adequate and thorough hearings.

While publicly working with Chairman Byrd, the White House was also working with Senator Russell Long to ensure the support of other Finance Committee Senators. The Committee limited the number of witnesses testifying on the bill, thus expediting the Committee's consideration. The Committee formally voted to report the legislation to the full Senate by a 12-5 vote, with the Chairman joining four Republicans against the measure. Soon after the vote, the Chairman injured his knee and subsequently missed the Senate floor consideration, only appearing to vote on final passage. The Social Security Act of 1965 created Medicare and Medicaid, providing medical care for elderly and low-income Americans.

Soon after passage of the Social Security Act of 1965, Senator Russell Long assumed the Finance Committee chairmanship. Chairman Long immediately made changes to the Committee structure. To contain costs, Chairman Byrd had always relied on staff from the Treasury Department and the Joint Committee on Taxation to brief Committee Senators. But this practice ceded influence to the Executive Branch. Chairman Long expanded the staff from the 2 in office when he became Chairman to 15 professionals who would both develop new ideas and draft legislation.

Some of the Chairman's first acts appeared small but had wide-ranging effects. Chairman Long was a firm believer in campaign finance reform, but he disagreed with the legislation that was making its way through the Senate in 1966. In an effort to alter the legislation, he developed a plan to pay for Presidential campaigns within the Finance Committee's jurisdiction. He proposed a check-off system, where taxpayers could donate $1 dollar of their taxes to a Presidential campaign fund when they filled out their tax returns. Chairman Long was able to get the check-off passed by tacking it onto the Foreign Investors Tax Act of 1966, for which he already had already built support by including many other Senators' provisions.

In 1966 Chairman Long also made another contribution to the nation and the history of the National Football League. The NFL was attempting to get Congressional approval of its merger with the AFL, but was being held up by the powerful House Judiciary Committee Chairman. With a week before the end of the Congressional session, NFL Commissioner Pete Rozelle sought out Chairman Long for advice on how to break the impasse. The Chairman decided he had a solution and that he could bypass the House Chairman by adding the merger language to a tax bill. But in order to secure passage, the next expansion franchise would have to be awarded to the city of New Orleans.

The bill passed the Senate easily and Congressman Hale Boggs took up the task of passing the measure in the House. Boggs easily won approval from Chairman Wilbur Mills of the Ways and Means Committee and the bill passed and was sent to President Johnson for his signature. On January 15, 1967, the first Super Bowl was played in Los Angeles with the Green Bay Packers defeating Kansas City Chiefs by a score of 35-10. It would take 43 years before the New Orleans Saints made it to their first Super Bowl.

By 1969, Congress saw the need for tax reform, especially after the Treasury Department released figures showing that many wealthy Americans avoided through a variety of loopholes paying any income taxes at all. The result was the Tax Reform Act of 1969, which combined provisions advanced by President Nixon and House leaders.

The 1969 law extended the surtax rates, increased capital gains taxes, repealed the 7 percent investment credit, and created the Alternative Minimum Tax, or AMT. House authors of the AMT created it to ensure that wealthy Americans paid their fair share of taxes, but the law did not index the tax to account for inflation.

When the bill came to the Senate, the Finance Committee cut some of the tax increases. The Senate-passed bill contained $3 billion more in tax reductions than the House-passed bill.

Working through the night, the conference committee agreed on a final bill on the 19th of December, and President Nixon signed the bill into law. The Tax Reform Act of 1969 reduced tax liabilities by 70 percent for those earning under $3,000 a year, while increasing taxes by 7 percent for those with incomes of more than $100,000 a year. Back to Top

The Modern Finance Committee (1970-Present)

By the late 1960s, many observers saw a need to reform the legislative and committee process. Congressional authors crafted the Legislative Reorganization Act of 1970 to protect minority rights and shine light on the congressional process. Among its reforms were published committee rules, television coverage of hearings, public committee roll-call votes, and limits on the use of proxies.

For the Finance Committee, the changes did not end there. The new Act mandated that each standing committee create subcommittees. For much of its history, the Finance Committee maintained only one subcommittee — the Subcommittee on Veterans. In the years leading up to the Legislative Reorganization Act, the Finance Committee was the only Senate committee without any subcommittees. By 1973, the Committee had created eight subcommittees to comply with the Legislative Reorganization Act.

The other major change for the Finance Committee was creation of the Veterans' Affairs Committee. For more than half a decade, veterans' organizations had lobbied for an independent Veterans' Affairs Committee in the Senate. In 1970, their efforts were rewarded, and the Finance Committee lost a major piece of jurisdiction. The Finance Committee left behind it a legacy of crafting new benefit programs for the nation's military personnel, revising disability programs for World War I veterans, and providing educational and employment benefits for veterans of World War II and the Korean War.

Around the same time, the Finance Committee was handling the thorny issue of welfare reform and an expansion of Social Security benefits. President Nixon proposed the Family Assistance Plan to provide an income supplement for unemployed families. Many in Congress, including Chairman Long, viewed this proposal as a giveaway. After more than a year of legislative maneuvering, Congress dropped the welfare programs, but adopted major changes in Social Security.

The Social Security Amendments of 1972 included two Finance Committee proposals. The first was a guaranteed monthly benefit for every person who worked for at least 30 years. The second — Supplemental Security Income, or SSI — was the brainchild of Chairman Long. SSI provided a monthly stipend for needy aged, blind, and disabled persons. And that same year, Congress approved automatic cost of living adjustments for those relying on Social Security.

The following year, President Nixon proposed comprehensive trade legislation in preparation for the Tokyo Round trade negotiations. As with previous trade legislation since the 1930s, the President sought Congressional approval to negotiate trade deals that Congress could not alter. A year after his proposal, Congress passed the 1974 Trade Act extending for 5 years the President's authority to negotiate deals and authorizing the reduction of tariffs by as much as 60 percent. During consideration of the bill, the Senate added requirements for the President to notify Congress at least 90 days in advance of a proposed agreement and for the President to consult with the appropriate congressional committees on any agreements.

The end of the 1970s and the first few years of the 1980s saw a number of changes to the tax code. During the waning days of the 1970s, Congress acted on the large profits that oil companies were recording. The result was a windfall profits tax, much like that instituted back during World War I, on oil company profits. In a last ditch effort to pass a compromise measure, Chairman Long, along with Senators Bennett Johnston and Lloyd Bentsen, filed more than a hundred second-degree amendments to the legislation to make clear that if the compromise bill did not pass, the Senate would be tied in knots for weeks. Their effort was rewarded, and the legislation passed.

In 1981, President Ronald Reagan came to office ready to fulfill his promise of tax cuts. The Economic Recovery Tax Act of 1981 reduced the marginal tax rate by 25 percent and indexed the tax code for inflation. Among the law's innovations was allowing all taxpayers to create Individual Retirement Accounts, or IRAs.

The year 1986 saw a major tax reform. President Reagan called for removing special privileges and simplifying the complex tax code. The House passed its version of the bill on December 16, 1985, reducing most individual tax brackets while increasing corporate taxes and the top tax rates for the wealthiest individuals. But many reformers feared that the effort would die in the more conservative Finance Committee.

Senator Robert Packwood, recently elevated to the Chairman's position when Chairman Robert Dole became Majority Leader, proposed an even more radical tax reform plan. The effort in the Committee was long and exhausting. A number of plans failed during the Committee's deliberations. Finally, Chairman Packwood offered a plan to reduce the top individual rate from the 38 percent in the House plan to 25 percent and to lower the corporate tax rate from 36 to 33 percent. While the Committee would eventually raise the top rate to 32 percent for individuals, the Committee agreed to the rest of Chairman's Packwood plan and approved it with a unanimous vote. The Senate approved the bill in late June.

Many special interests sought to kill the reform effort. Chairman Packwood and Ways and Means Committee Chairman Dan Rostenkowski negotiated the final legislation in private. Congress passed the conference bill and President Reagan signed it into law on October 22, 1986. The Tax Reform Act of 1986 lowered individual tax rates, increased personal exemptions, took 6 million of the poorest Americans off of the tax rolls, and reduced the top corporate tax rate from 48 percent to 34 percent.

By the latter half of the 1980s, the trade issue once again gained the public spotlight. In 1988, Congress passed the Omnibus Trade and Competitiveness Act. The bill was a compromise measure between the Democratically-controlled Congress and President Reagan. The President vetoed the first bill, and the Senate narrowly failed to override the veto. The Act expanded TAA, granted the President more authority to negotiate trade agreements, and granted trade relief to industries injured by imports.

Also in 1988, the United States signed a free trade agreement with Canada. And in 1992, the U.S. agreed to expand that agreement to cover the United States, Canada, and Mexico in the North American Free Trade Agreement, or NAFTA. Debate on the legislation to implement NAFTA was contentious. Major labor unions came out against the bill. In the House, Majority Leader Dick Gephardt opposed the agreement. Despite his opposition, the House approved the agreement 234 to 200. The Finance Committee took 5 days to consider the agreement. In the end, the Committee reported the measure on a 14-4 vote, with Chairman Moynihan voting against passage. Two days later, the Senate approved the bill with a 61 to 38 vote.

By the end of the decade, the Finance Committee handled a variety of legislative issues. In 1996, the Committee tackled the issue of welfare reform. After an initial veto, President Bill Clinton and the Republican-controlled Congress managed to compromise and replace the Aid to Families with Dependent Children program with the Temporary Assistance for Needy Families block grant.

In 1997, the Committee helped to develop the Children's Health Insurance Program, or CHIP.

In one of its last major acts before the new millennium, the Finance Committee made several changes to IRS reform legislation. After a series of public hearings detailed abusive tactics at the IRS, the Committee helped to increase the authority of the Office of the Taxpayer Advocate and assisted in the creation of the Treasury Inspector General for Tax Administration to investigate any allegations of IRS abuse.

Since the start of the 21st Century, the Finance Committee has continued its leadership on tax, trade, and health issues. Shortly after President George W. Bush took office, the Committee passed the Economic Growth and Tax Reconciliation Act, a major tax cutting bill.

The following year, Congress passed the Trade Act of 2002, which renewed fast-track authority for the first time since 1994. In the years following, the Committee approved of a number of free trade agreements, including with Chile, Singapore, Australia, Morocco, CAFTA and the Dominican Republic.

In 2003, the Committee was instrumental in passage of additional tax cuts in the Jobs and Growth Tax Reconciliation Act. And that year, the Committee led the creation of a new benefit under Medicare providing for coverage of prescription drugs, the largest such increase in the program's history.

And in 2009 and 2010, the Committee devoted months of work to comprehensive health care reform. The result was enactment of the sweeping Patient Protection and Affordable Care Act in March of 2010.

Over the past decade the committee has continued its bipartisan approach on finding solutions to issues within its jurisdiction. In 2014 the committee passed the bipartisan Trade Promotion Authority and the following year enacted legislation that had originally been advanced by the committee to permanently repeal the Medicare Sustainable Growth Rate.

In 2016, the Finance Committee celebrated its bicentennial and continued its tradition of passing major legislation by advancing one of the largest tax overhauls in three decades, providing reforms to individual, business and international sides of the U.S. tax code.

It is apparent that the committee continues to be a prime focus of many issues that affect the nation and one of the most influential committees in the United States Senate.