JCT: U.S. Stands to Lose Revenue Under OECD Tax Deal

Biden Administration’s “America Last” policy shifts jobs and tax revenues out of the United States

Washington, D.C.— The United States stands to lose over $120 billion in tax revenues under the Organization for Economic Co-operation and Development’s (OECD) global minimum tax—known as Pillar 2—negotiated by the Biden Administration, according to an analysis by the nonpartisan Joint Committee on Taxation (JCT). The analysis was requested by Senate Finance Committee Ranking Member Mike Crapo (R-Idaho) and House Ways and Means Committee Chairman Jason Smith (R-Missouri).

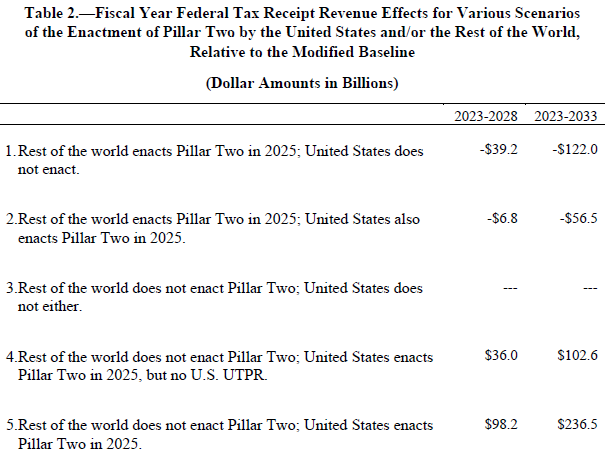

JCT considers various scenarios of adopting OECD’s global minimum tax in the United States and other countries. Under the current trajectory, JCT estimates the U.S. will lose more than $120 billion of tax revenue. Even under the scenario pushed by the Biden Administration, JCT estimates the U.S. will lose almost $60 billion. Moreover, these estimates do not even account for U.S. revenue loss from the almost 50 countries that have already enacted the tax scheme or have announced plans to do so.

In response, Finance Committee Ranking Member Crapo and Ways and Means Committee Chairman Smith said:

The Biden Administration unilaterally surrendered to the OECD tax cartel by agreeing to a global tax code that will extract more than $120 billion in US tax revenue over the next decade—unless Congress also surrenders its sovereignty over U.S. tax policy. This is a lose-lose deal negotiated by the Biden Administration. Even if Congress did implement OECD’s global minimum tax by 2025 along with the rest of the world, the U.S. would still lose tens of billions of dollars, and likely much more if it does not stack another book tax on the shelf alongside the Democrats’ dizzying book minimum tax. Worse, by agreeing to prioritize the OECD’s tax scheme over the Republican-enacted global minimum tax from 2017, the Biden Administration handed each foreign country a model vacuum to suck away tens of billions from our tax base.

Not only does the OECD’s global tax code undermine U.S. sovereignty to enact its own tax policy and vault foreign countries ahead by encouraging a subsidy race to the bottom, but this ‘America Last’ policy shifts jobs and—as this analysis makes clear—tax revenues out of the United States.

The JCT analysis provides five alternative scenarios against a baseline assuming nearly 50 countries (including all EU countries) have already enacted Pillar 2.

Scenario 1: Rest of world enacts Pillar 2 in 2025; U.S. does not enact

JCT estimates that the U.S. will lose more than $120 billion if the rest of the world adopts Pillar 2 in 2025, primarily due to countries enacting domestic minimum taxes that will soak up taxes currently collected under the U.S. global minimum tax.

Scenario 2: Rest of world enacts Pillar 2 in 2025; U.S. enacts Pillar 2 in 2025

Under the Biden Administration’s preferred path forward, the U.S. would still lose $56.5 billion. Additional taxes collected by enacting another U.S. domestic minimum tax and a small increase in profits moving into the U.S. are insufficient to dig out of the more than $120 billion hole. What’s more, the projected tax revenue in this scenario is likely overstated, as it assumes the U.S. would adopt the OECD’s domestic minimum tax in addition to the existing book minimum tax enacted by Democrats in their so-called Inflation Reduction Act.

Scenario 3: Rest of world does not enact Pillar 2; U.S. does not either

While this scenario estimates no revenue effect, it is a very unlikely path—and does not take into consideration revenue already lost from the nearly 50 countries JCT identified that have already enacted Pillar 2 or announced plans to do so.

Scenarios 4 and 5: Rest of world does not enact Pillar 2; U.S. enacts Pillar 2 in 2025 (without and with implementation of the extraterritorial Undertaxed Profits Rule, UTPR)

For academic completeness, Scenarios 4 and 5 assume that the U.S. is the only additional country to adopt Pillar 2 in 2025. As noted, JCT identified nearly 50 countries that have already enacted Pillar 2 or announced plans to do so. The only difference between Scenario 4 and Scenario 5 is adoption of a U.S. UTPR.

Not only are these last two scenarios highly unlikely, but also the estimated revenue gains assume the United States keeps Democrats’ existing book minimum tax and adopts the OECD’s domestic minimum tax.

Next Article Previous Article