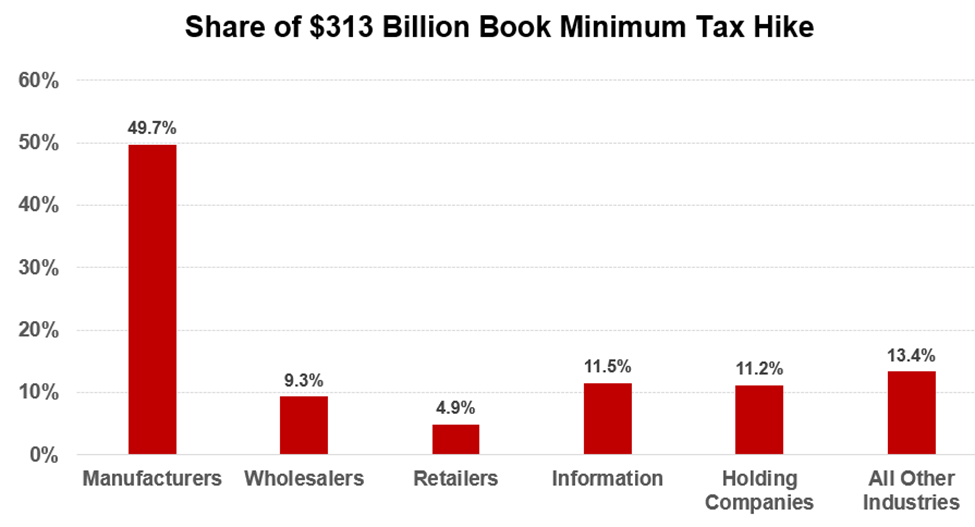

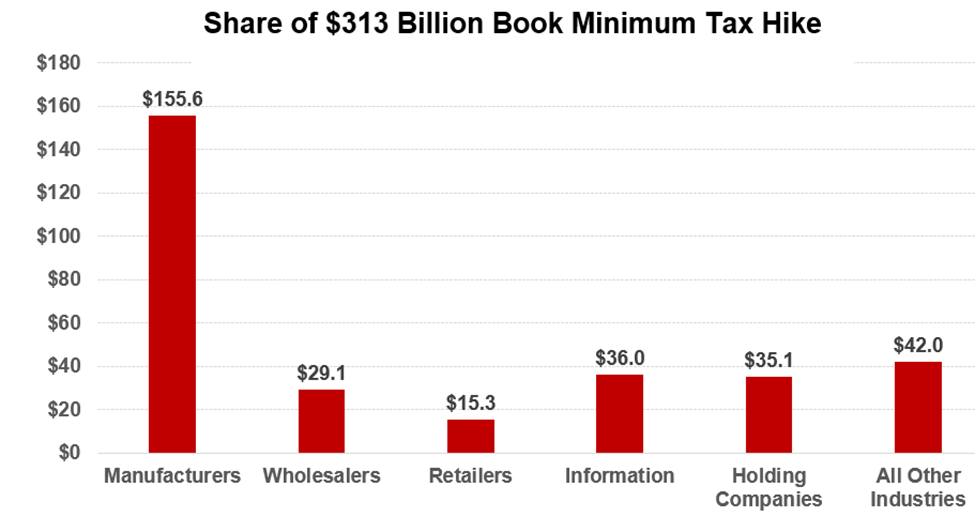

JCT Confirms: U.S. Manufacturers Would be Hardest Hit by Democrats' Book Minimum Tax

Congress’s nonpartisan scorekeeper confirms half of the $313 billion book minimum tax increase would be borne by manufacturers

Washington, D.C.--A new analysis by the nonpartisan Joint Committee on Taxation (JCT) of the book minimum tax proposal in the latest version of the Democrats’ reckless tax-and-spend bill (the 15 percent minimum tax on corporations) would overwhelmingly hit U.S. manufacturers at a time when they can least afford it.

Senate Finance Committee Ranking Member Mike Crapo (R-Idaho), who requested the analysis, said, “The JCT confirmed what we have been saying for over a year: this fundamentally flawed proposal, which has not been properly vetted by either Congressional tax-writing committee, risks severely harming American manufacturers, exacerbating supply-chain disruptions, and ultimately costing U.S. jobs and investment.

“This is a domestic manufacturing tax, plain and simple,” he continued. “Now is not the time to resurrect a harmful policy that would overwhelmingly hit American manufacturers and supply chains, as well as undercut critical research and development and investment in emerging technologies.”

Democrats claim the book minimum tax is a tax loophole closer, when in reality it is a tax on U.S. manufacturers. Based on the new JCT analysis, 49.7 percent of the tax would be borne by the manufacturing industry at a time when manufacturers are already struggling with inflation, supply-chain disruptions, and an impending recession.

Despite Democrats’ claims, the book minimum tax does not close tax loopholes. Tax and book treatment of capital investments, like those made by American manufacturers, differ for book and tax purposes – for good reason. Congress intentionally designed tax depreciation rules to support domestic investment. Democrats’ tax on U.S. manufacturing would eliminate that benefit.

Finance Committee Republicans previously urged colleagues to abandon efforts to implement a “book minimum tax,” which has already been tried and rejected on a bipartisan basis, detailing the problematic and unaddressed issues that have resulted from such proposals in the past. As the senators note, Republicans and Democrats rejected a previously enacted book minimum tax due to its numerous flaws and negative effects.

Next Article Previous Article