Finance Committee Republicans: IRS Should Speed Up Paper Returns Process

In letter to Commissioner Rettig, senators urge implementation of 2-D barcoding technology

Washington, D.C.--Senate Finance Committee Republicans, led by Ranking Member Mike Crapo (R-Idaho), wrote to Internal Revenue Service (IRS) Commissioner Chuck Rettig to strongly encourage the agency to implement 2-D barcoding for paper returns in the 2023 tax filing season--technology that would help to efficiently process millions of tax returns and speed up taxpayer refunds.

Processing paper returns is a tedious, time-consuming process, and the pandemic led to an unprecedented backlog of paper returns at the IRS. As the senators note in the letter, “For taxpayers due a refund, an IRS backlog means refund delays and possible financial hardship. For others, the backlog means the unavailability of tax transcripts necessary to secure a loan or employment.”

In March, the National Taxpayer Advocate (NTA) recommended the IRS implement 2-D barcoding for paper tax returns, which would concisely encode relevant data and import it in digital form into the IRS’s computer systems, bypassing time-consuming manual data entry and streamlining the process. However, the IRS has signaled it is unlikely to do so.

In the letter, the senators make several arguments in favor of implementing 2-D barcoding:

- Millions of taxpayers need their refunds. 2-D barcoding will help efficiently process millions of tax returns and speed up taxpayer refunds.

- It is affordable and the IRS has the funds. The American Rescue Plan of 2021 earmarked $1.86 billion toward the IRS to among other things provide taxpayer assistance, including $1 billion specifically for IT modernization. Entering into 2022, only $98.5 million of the $1 billion was spent. In 2017, the IRS estimated the cost for implementing 2-D barcoding technology was $8.3 million.

- There is an urgent need to address the problem now, not in five years.

- Stop chasing technological perfection. If we were to wait for the promise of better technology, nothing would ever get implemented. 2-D technology has been tested and is less expensive, and many states currently use it.

- 2-D barcoding will likely pay for itself. Faster processing means faster refunds. The result will be improved taxpayer outcomes and a reduction in the billions of dollars the IRS pays in interest.

Read the full letter, signed by all Senate Finance Committee Republican members, here or below.

____________________________________

Dear Commissioner Rettig:

We are writing to strongly encourage the Internal Revenue Service (IRS) to work with tax return software companies to implement 2-D barcoding technology for use during the 2023 tax filing season for the 1040 family of paper returns.

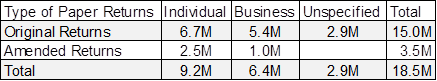

The pandemic started an unprecedented backlog of paper returns at the IRS. As of the week ending April 29, 2022, the IRS reported the following backlog:

The National Taxpayer Advocate (NTA) reported that in 2021, 77 percent of individual taxpayers received a refund. For taxpayers due a refund, an IRS backlog means refund delays and possible financial hardship. For others, a backlog means the unavailability of tax transcripts necessary to secure a loan or employment.

On March 29, 2022, the NTA sent the IRS a directive recommending the IRS work with the tax software industry to implement 2-D barcoding for the 2023 tax filing season. The NTA noted since 2002, 17 states have used 2?D barcoding for paper returns prepared with tax return software. Also, 50-60 percent of paper individual income tax returns were prepared with tax return software and would not need to be manually transcribed if 2-D barcodes were added.

We consider the following points outweigh objections to implementing 2-D barcoding for the 2023 tax filing season.

- Millions of taxpayers need their refunds. Assuming 77 percent of individual taxpayers receive refunds, based on the above current backlog statistics, roughly 8 million individual taxpayers who filed paper returns are waiting for their refund. During pre-COVID times, the IRS would tell taxpayers that refunds generated from paper returns took about 4-6 weeks. Now taxpayers are waiting longer, much longer. Some of our constituents are waiting 10-13 months for their refund. It is time to stop pushing this problem forward. 2-D barcoding will help efficiently process millions of tax returns and speed-up taxpayer refunds.

- It is affordable and you have the funds. The IRS’s budget request for 2017 said the cost of implementing 2-D barcoding was approximately $8.4 million. The American Rescue Plan of 2021 earmarked $1.86 billion toward the IRS to, among other things, provide taxpayer assistance, including $1 billion specifically for IT modernization. Entering into 2022, $98.5 million of the $1 billion was spent.

- There is an urgent need to address the problem now, not in five years.

- Stop chasing technological perfection. If we were to wait for the promise of better technology, nothing would ever get implemented. To the contrary, the fact the 2-D technology is a bit older probably means it has been tested and is less expensive. Many states currently use 2-D barcoding for tax returns, so we have proof it works.

- 2-D barcoding will likely pay for itself. With 2-D barcoding, the IRS will be able to do more with fewer people. Additionally, GAO reported, the IRS paid $3.3 billion in interest payments for FY 2021 due to refund processing delays. Faster processing will mean faster refunds. The result will be improved taxpayer outcomes and a reduction in the billions of dollars the IRS pays in interest.

We appreciate the 2-D barcoding is not a panacea. For example, returns will still need to be inspected for manual overwrites and unreadable barcodes. Nevertheless, if professionally implemented, 2-D barcoding can effectively bridge the paper and digital worlds. Let’s make progress in giving taxpayers the IRS they deserve. Let us implement 2-D barcoding for the 2023 filing season.

Thank you for your immediate consideration of this matter.

Sincerely,

###

Next Article Previous Article