Crapo on Extension of Trump Tax Cuts: Failure is Not an Option

“We must prevent a massive tax hike and provide relief and certainty to families and businesses across America.”

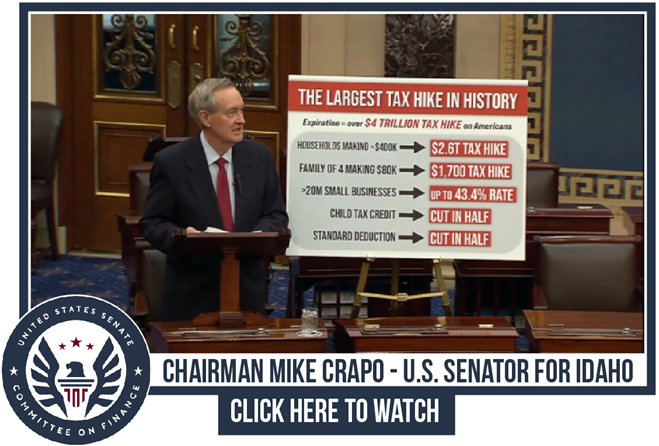

Washington, D.C.--Ahead of debate on the Senate FY2025 Budget Resolution, U.S. Finance Committee Chairman Mike Crapo (R-Idaho) set the record straight on the pro-growth Trump tax cuts, which lowered rates for Americans across the board and benefitted middle-income Americans the most. He warned that, if the tax cuts are allowed to lapse at the end of the year, American families and businesses will face the largest tax hike in U.S. history.

Watch Crapo's remarks here.

Full remarks as delivered:

“Today, we are debating the narrow Senate FY2025 Budget Resolution that fulfills promises to secure America’s borders, increase our national defense, unleash our energy potential and finally start to get our fiscal house in order.

“In the near future, I expect us to move forward with a Budget Resolution that allows us to prevent a more than $4 trillion tax hike on American households--the largest tax hike in history of America--that will be felt by virtually every American if the tax cuts expire at the end of this year.

“Because the other side has filed a litany of tax amendments that rehash various false narratives and each side will only have one minute to debate, I’m going to spend some time right now explaining why we can’t afford a $4 trillion-plus tax increase; the positive impact the Trump tax cuts had on the economy; and some of the key provisions that expire at the end of year.

“At the end of this year, many key provisions of President Trump’s 2017 Tax Cuts and Jobs Act are set to expire, triggering an over-$4 trillion tax hike on American families and businesses.

“While taxes will increase on Americans of all income levels, the majority of this tax hike, about $2.6 trillion, will fall on those making less than $400,000 per year.

“An average family of four making about $80,000 per year would see a $1,700 tax hike in 2026.

“Another $600 billion plus will hit millions of small business owners, who could see federal tax rates skyrocket up to 43.4 percent.

“Tens of millions of families will see their child tax credit cut in half from $2,000 to $1,000.

“The list goes on, but first I’ll talk about what the Trump tax cuts actually did, and why failing to extend key provisions would be economically devastating for millions of hardworking taxpayers.

“So, what did the Trump tax cuts do?

“There’s been a lot of talk recently about how extending these expiring tax cuts are all for billionaires and corporations, but the facts show otherwise.

“The 2017 tax bill increased take-home pay and powered a growing economy.

“Individuals across all income brackets received a tax cut, not just--as opponents suggest--for the uber wealthy.

“In fact, the Trump tax cuts made the tax code more progressive, meaning the highest income earners now pay a greater share of all income taxes than they did before 2017.

“The majority of benefits accrued to working middle-class families.

“Between the bill’s passage in 2017 and 2021, the bottom 50 percent of earners received the largest reduction in average tax rates at 17.3 percent.

“The effects of pro-growth tax reform were almost immediate.

“Not only did taxpayers get to keep more of their hard-earned money, but a growing economy helped median household income reach an all-time high.

“The labor market improved, workers saw wage growth and the unemployment rate fell dramatically to 3.5 percent--the lowest in 50 years.

“And the lowest-income workers experienced the largest wage growth.

“Corporate inversions became a thing of the past, and America became the place to do business.

“All Americans reaped the benefits of a booming economy.

“As American families contend with increased costs of everyday living, the last thing they need is another massive tax hike on top of that inflation.

“Failure is simply not an option.

“So, what happens if the Trump tax cuts expire?

“As I’ve said, if we do not extend these tax policies, Americans will be hit with an over-$4 trillion tax increase.

“More than $2.6 trillion will fall on households earning less than $400,000 per year.

“An average family of four making $80,000 will be saddled with a $1,700 tax increase. This is the equivalent of six to eight weeks’ worth of groceries for a family of four.

“Tens of millions of families will see their child tax credit cut in half to $1,000, and

90 percent of taxpayers would see their standard deduction cut in half.

“Owners of over 20 million small businesses will face a massive tax hike, with tax rates up to 43.4 percent.

“7 million taxpayers will be impacted by the Alternative Minimum Tax, up from just 200,000 taxpayers currently.

“Many more small businesses and farms will have their death tax exemption cut in half.

“The National Association of Manufacturers recently highlighted that if we allow the Trump tax cuts to expire, 6 million jobs would be at risk; $540 billion in employee compensation will be lost, and U.S. GDP will be reduced by $1.1 trillion.

“So, while we aren’t considering tax policy as part of this reconciliation package, it is important to set the record straight on what’s at stake in the upcoming tax debate.

“And the stakes couldn’t be higher.

“Tonight, you’re going to hear dozens and dozens of tax amendments, and we’re going to respond to each of those by explaining that that debate is not this budget.

“The budget that we’re debating today is on the border, national defense, and increasing our oil and gas production to strengthen our economy.

“And Senate and House Republicans are working together to act as quickly as possible to make the Trump tax cuts permanent, but that will be in the next step.

“We must prevent a massive tax hike and provide relief and certainty to families and businesses across America.”

###

Next Article Previous Article