Crapo: Make Trump Tax Cuts Permanent

Reliability, permanence provide greatest economic growth

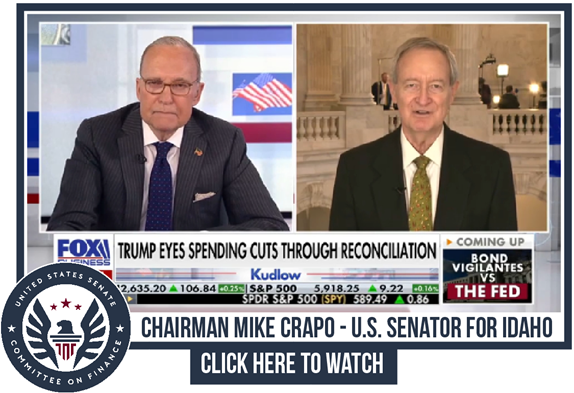

Washington, D.C.--U.S. Finance Committee Chairman Mike Crapo (R-Idaho) joined Larry Kudlow on Fox Business to talk about the effort to make President Trump’s 2017 tax cuts permanent and prevent an over $4 trillion tax hike on American taxpayers.

Click here to watch.

On why a $4 trillion tax hike is different than $4 trillion in deficit spending:

Kudlow: “I want to get to your current policy baseline, which is one of the reasons we love having you on, because people do not appreciate your point of view. First of all, the Congressional Budget Office and the Joint Tax Committee are always wrong. The 2017 tax cuts—they have now paid for themselves. They unfortunately paid for a lot of other things, bad spending, things. That's one point. Second point is, your point about current policy baseline, if this is a permanent tax cut and you're just extending it, why does it have to be scored at $3 or $4 or $5 trillion the way the CBO is going to do it?”

Crapo: “It doesn't have to be, and I think almost every American who has any common sense understands that. If you're not changing the tax code, you're simply extending current policy—you are not increasing the deficit. The bottom line here is that it's a $4.3 trillion tax increase, not a $4.3 trillion deficit increase. You've indicated it—we grow the economy, we save people from massive tax hikes—tax increases that hurt them terribly, and we give permanency to the tax code. We've got to get some kind of sensibility into the way that we score.”

On Washington’s tax-and-spend problem:

Kudlow: “The other thing is, this business about the current services baseline, so these spending programs go on forever, but they're not scored as deficit increasers, but if tax cuts are coming in and they go on forever, they're scored as deficit raisers. It's like the whole system is geared for government to take your money rather than for you to keep more of what you earn.”

Crapo: “That's exactly right, and let's not be fooled by this—if we had a $4.3 trillion tax increase, Congress would use it on new spending. It's a tax-and-spend philosophy, and you indicated that about $2.5 trillion of the spending is under current policy baseline that's intended to protect the spending, so it goes on perpetually. But the taxes don't get the same kind of treatment. I think that Americans can see through this.”

Next Article Previous Article