Press Contact:

202-224-4515, Katie Niederee and Julia Lawless

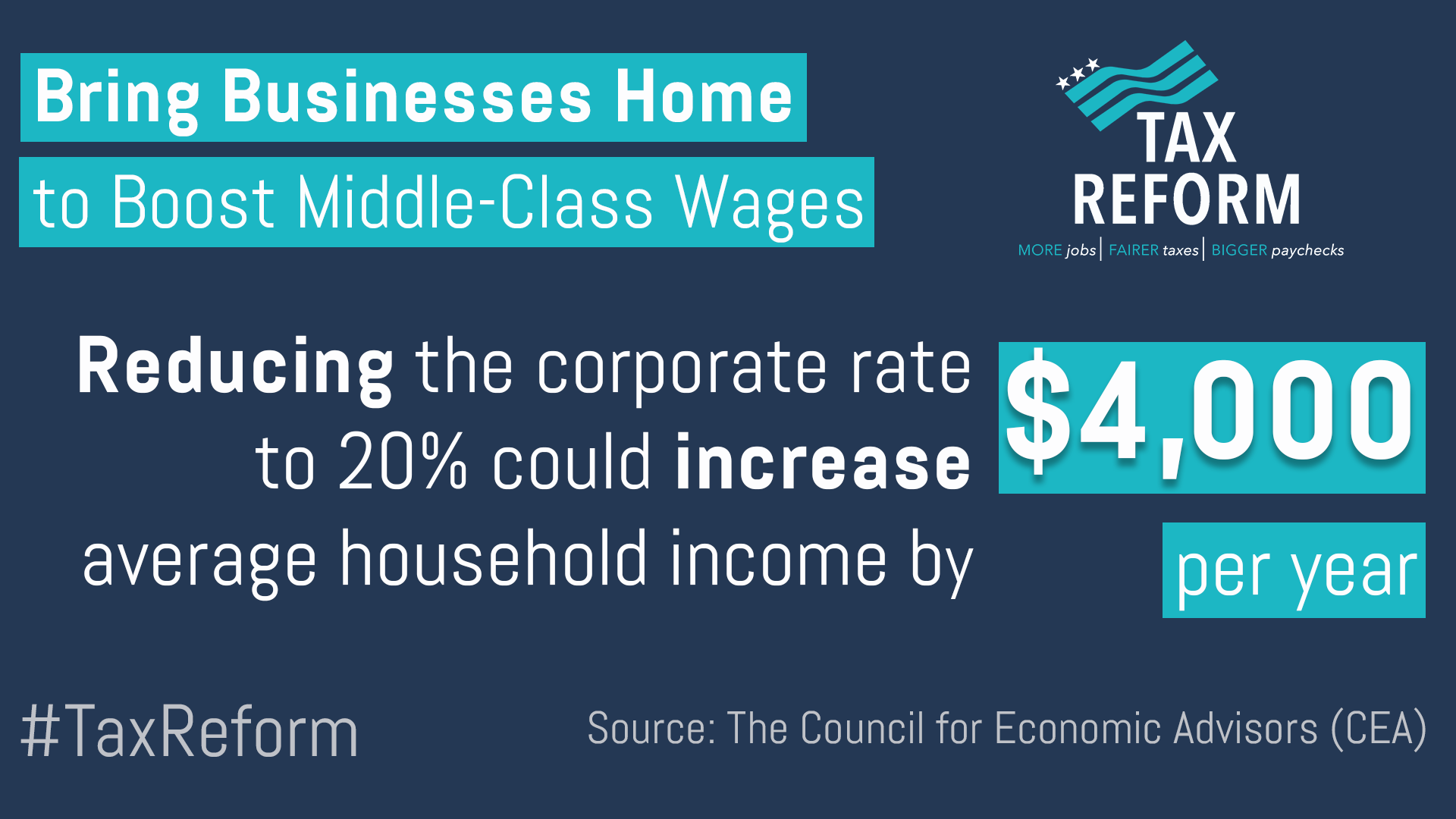

Tax Talk: Studies Show Corporate Tax Changes Will Boost Growth, Wages in America

A Significant Drop in the Corporate Tax Rate Means a Healthy Jump in Wage & Economic Growth

At an astounding 39 percent, the United States takes the cake for having the highest statutory corporate tax rate in the developed world. The nation’s effective corporate tax rate, or the actual rate paid after deductions and credits, is also globally uncompetitive, ranking fourth highest among G-20 countries.

If American companies are struggling to compete with their foreign counterparts, it also makes investing at home, in the form of hiring new workers, increasing paychecks or developing new products, even more difficult.

The unified tax reform framework released last month recognizes this challenge. It brings America’s corporate tax rate in line with the rest of the developed world, reducing it to 20 percent – below the 22.5 percent average of the industrialized world. Pairing a lower corporate tax rate with a shift to a territorial tax system with base erosion protections – another recommendation in the framework – will help America compete in the 21st century economy and end incentives to ship jobs and capital overseas.

And, the data are there to back it up. Take a look:

- The Council for Economic Advisors (CEA) released a study this week that found, “…reductions in corporate tax rates increase the demand for workers and heighten their productivity.” And, according to the CEA analysis, the unified framework could raise average household income by $4,000 per year or more.

- Boston University Professor Laurence Kotlikoff did a recent analysis of the framework and found its policies will grow the economy by 3 to 5 percent, translating to an uptick in inflation-adjusted wages by between 4 and 7 percent.

- That same Kotlikoff study said much of the growth is a direct result of reducing the corporate tax and transitioning to a territorial system, which increases productivity and capital formation in the United States. Increased productivity and accompanying wage growth could mean roughly $3,500 more per year in the pockets of the average American family.

- Another study by National Retail Federation found that if Congress reduces the corporate tax rate to 20 percent, as proposed in the unified tax framework, “…wages could increase in the range of $32 billion to $97 billion.”

- And a Business Roundtable survey found that 82 percent of CEOs say that tax reform will lead to more capital spending, 76 percent of CEOs say it will lead to more hiring and 77 percent of them say it will make them more globally competitive.

Congress understands it needs to take action to make the United States a more inviting place to do business. Comprehensive tax reform, that updates America’s outdated corporate tax structure, can help keep more jobs and investment here at home and give the American people a much-deserved pay raise.

###

Next Article Previous Article