Press Contact:

202-224-4515, Katie Niederee and Julia Lawless

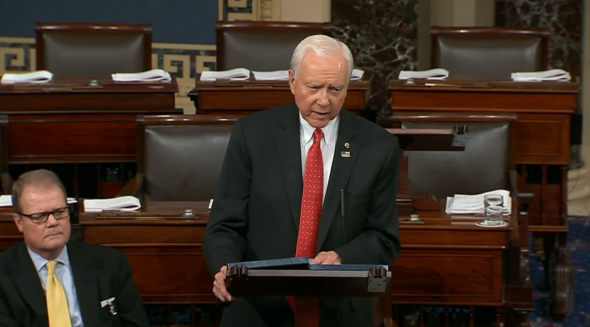

Senate Overwhelmingly Approves Hatch Amendment to Strengthen Medicare & Medicaid

Senate Votes 89-9 in Favor of Hatch Amendment to Protect Vulnerable & Improve Long-Term Outlook for Critical Safety Net Programs

WASHINGTON — Today the U.S. Senate voted 89-9 in favor of Senate Finance Committee Chairman Orrin Hatch’s (R-Utah) amendment #1144 to H. Con. Res. 71, the FY2018 Budget Resolution.

The amendment provides a reserve fund for future legislation that would strengthen and improve Medicaid and extends the exhaustion date for the Medicare Part A Hospital Insurance Trust Fund if it does not increase the federal deficit over the term of the budget.

“Put simply, we need to address the fiscal challenges facing [Medicare and Medicaid] if we’re going to preserve them for future generations,” Hatch said on the Senate floor prior to the vote. “Furthermore, the budget resolution does not propose any specific programmatic changes to either Medicare or Medicaid, even though my friends on the other side of the aisle like to argue otherwise…Despite a number of claims to the contrary, the budget resolution does not rely on savings from Medicaid in order to provide tax relief… A vote for my amendment is a vote for a stronger, more fiscally sound safety net that preserves Medicaid for our most vulnerable citizens, keeps our promises to Medicare’s current beneficiaries, and strengthens the program for those who will need it in the future.”

Hatch’s full floor remarks can be found below:

Mr. President, I rise to speak in support of my amendment – Amendment Number 1144.

This legislation is designed to do two things.

First, it would protect Medicaid for our nation’s most vulnerable citizens, namely, low-income children, pregnant women, the elderly, and those with disabilities.

In addition, it would strengthen Medicare in order to help protect health benefits for current and future beneficiaries.

Make no mistake, Mr. President, our nation faces a growing entitlement crisis, and Medicare and Medicaid are at the heart of it.

Under Obamacare, Medicaid enrollment has increased by about 28 percent due to the expansion of the program in 32 states. Between 2014 and 2015 alone, expansion states received about $79 billion in federal funds.

The problem, Mr. President, is that, even before Obamacare, Medicaid was plagued by quality issues and states’ hands were tied whenever they tried to advance innovative solutions to improve patient care. And, of course, even before Obamacare, Medicaid spending – at both the federal and state level – was growing at an astronomical rate.

Contrary to popular myth, Obamacare didn’t fix this. It made things worse.

As chairman of the committee with jurisdiction over Medicaid, I have been working with a number of my Republican colleagues, as well as state officials, stakeholders, and the American public to find solutions that will improve the quality and ensure the longevity of the Medicaid program. That work will continue into the future.

Medicare is a separate problem entirely.

Everyone knows that, when it comes to Medicare, we are a collision course with fiscal and economic catastrophe.

Over the long-term, Medicare faces more than $33 trillion in unfunded liabilities, according to the independent actuaries at the Centers for Medicare and Medicaid Services.

In the nearer term, the Medicare trustees project that Medicare Part A, which deals with inpatient hospital payments, will be officially bankrupt in 2029, resulting in steep benefit cuts for seniors relying on the program. Even a number of prominent Democrats who recently served as Medicare trustees have recommended swift legislative action to “minimize the impact on beneficiaries, providers, and taxpayers.”

Put simply, we need to address the fiscal challenges facing these programs if we’re going to preserve them for future generations.

And, despite the claims of a number of my Democratic colleagues, we can’t even make a dent in these problems by focusing solely the tax side of the equation.

I know many like to claim that every wrong will be righted and every problem will be solved if we’d simply raise taxes on rich people. But anyone who has spent more than five minutes looking at the fiscal condition of our federal health programs will tell you that is preposterous. The money just simply isn’t there.

The Republican budget acknowledges this reality.

My colleagues have argued that the budget would cut Medicare spending, but, that isn’t true. In fact, under the budget, Medicare spending would increase every year, though at a slightly slower rate in order to introduce some level of fiscal sanity into the process.

All told, the budget would slow Medicare’s rate of growth by about one percent compared to the CBO baseline.

Furthermore, the budget resolution does not propose any specific programmatic changes to either Medicare or Medicaid, even though my friends on the other side of the aisle like to argue otherwise.

Let me be clear on another point: Despite a number of claims to the contrary, the budget resolution does not rely on savings from Medicaid in order to provide tax relief.

My colleagues, the Ranking Member of the Budget Committee and the Senior Senator from Florida, have proposed amendments to dramatically increase taxes – to the tune of about a trillion dollars for Medicaid and half a trillion dollars for Medicare over the next decade – in order to double and triple down on the failed policies that have made these programs unsustainable in the first place.

These aren’t serious proposals, Mr. President. They are poison pills, designed only to give the other side a round of partisan talking points.

A vote for my amendment is a vote for a stronger, more fiscally sound safety net that preserves Medicaid for our most vulnerable citizens, keeps our promises to Medicare’s current beneficiaries, and strengthens the program for those who will need it in the future.

I urge all of my colleagues to vote in favor of my amendment.

###

Next Article Previous Article