Press Contact:

202-224-4515, Katie Niederee and Julia Lawless

Leveling the Playing Field for American Small Businesses

A Fairer Tax Rate to Help Main Street Compete

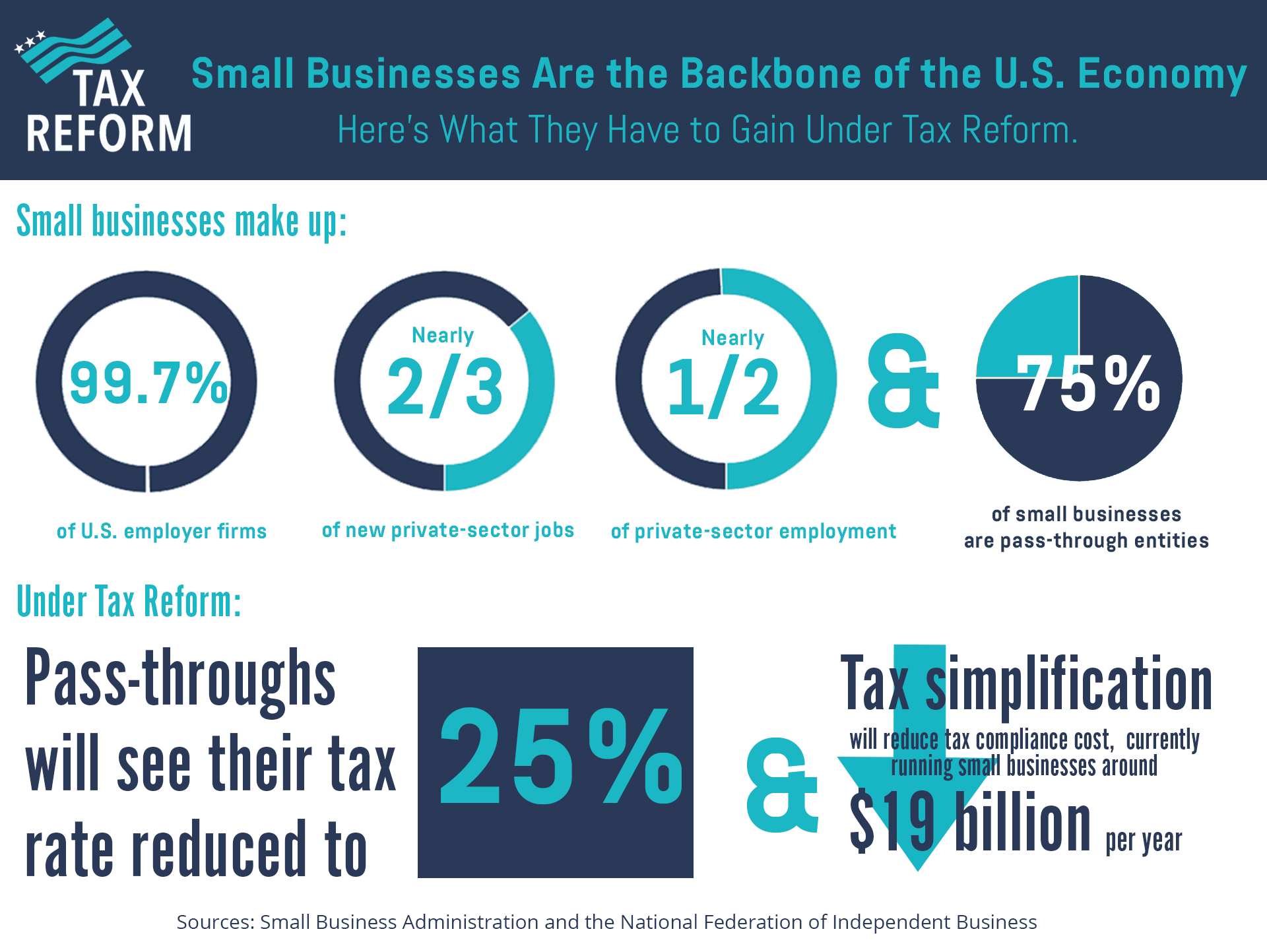

Small businesses are the backbone of the American economy, capable of creating more than 1 million new jobs in a year and employing approximately half of the American workforce.

Of the nearly 29 million U.S. small businesses, 75 percent are unincorporated pass-through entities. Under the current system, pass-through income is taxed as individual income, which means that pass-through businesses face a tax rate as high as 43 percent. Tax reform will create a separate, 25 percent rate for pass-throughs, leveling the small business playing field and better equipping them to compete, create jobs, and grow our economy.

The tax reform framework explicitly says that the tax-writing committees will include safeguards to prevent high-income earners from re-characterizing personal income to business income in order to pay a lower rate. In other words, the unified framework provides much-needed tax relief for small businesses while also preventing wealthy taxpayers from gaming the system.

Simplifying the tax code will also benefit these critical job creators. Small businesses often lack accounting expertise and proper resources to handle tax compliance, which means these administrative tasks often fall to owners, diverting them from their core purpose. Making the tax code simpler will reduce the tax compliance costs, which currently run, for small-business owners, around $19 billion per year.

The less small businesses pay in tax compliance, the more they can spend on other business costs, like hiring new employees, investing in new equipment, and giving their workers a pay raise.

Bottom line: Tax reform will create a fairer system for small businesses, which will allow them to invest in their workforce, leading to more jobs and bigger paychecks for more American workers.

Sources: Small Business Administration and the National Federation of Independent Business

###

Next Article Previous Article