Press Contact:

202-224-4515, Katie Niederee & Julia Lawless

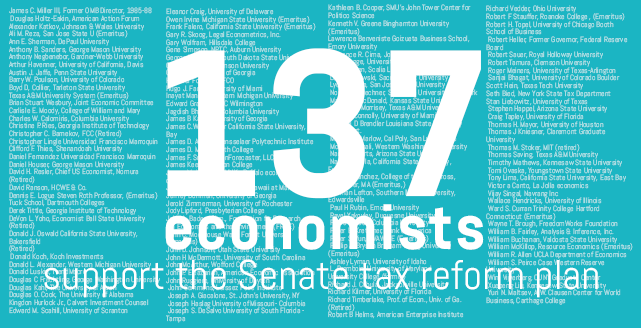

ICYMI: 137 Economists Support the Senate Tax Reform Plan

A group of 137 economists today urged Congress to pass tax proposals being considered in the Senate.

“[W]hen it comes to the tax reform package aimed at fixing our broken system, the undersigned have but one shared perspective: Economic growth will accelerate if the Tax Cuts and Jobs Act passes, leading to more jobs, higher wages, and a better standard of living for the American people,” the economists wrote in a letter. “If, however, the bill fails, the United States risks continued economic underperformance…”

The full letter can be found below:

Dear Senators and Representatives:

"Ask five economists," as the Edgar Fiedler adage goes, "and you'll get five different answers."

Yet, when it comes to the tax reform package aimed at fixing our broken system, the undersigned have but one shared perspective: Economic growth will accelerate if the Tax Cuts and Jobs Act passes, leading to more jobs, higher wages, and a better standard of living for the American people. If, however, the bill fails, the United States risks continued economic underperformance.

In today's globalized economy, capital is mobile in its pursuit of lower tax jurisdictions. Yet, in that worldwide race for job-creating investment, America is not economically competitive.

Here's why: Left virtually untouched for the last 31 years, our chart-topping corporate tax rate is the highest in the industrialized world and a full fifteen percentage points above the OECD average. As a result of forfeiting our competitive edge, we forfeited 4,700 companies from 2004 to 2016 to cheaper shores abroad. As a result of sitting idly by while the rest of the world took steps to lower their corporate rates, we lowered our own workers' wages by thousands of dollars a year.

Our colleagues from across the ideological spectrum – regardless of whether they ultimately support or oppose the current plan – recognize the record-setting rate at which the United States taxes job-creating businesses is, either significantly or entirely, a burden borne by the workers they employ. The question isn't whether American workers are hurt by our country's corporate tax rate – it's how badly. As such, the question isn't whether workers will be helped by a corporate tax rate reduction – it's how much.

The enactment of a comprehensive overhaul – complete with a lower corporate tax rate – will ignite our economy with levels of growth not seen in generations. A twenty percent statutory rate on a permanent basis would, per the Council of Economic Advisers, help produce a GDP boost "by between 3 and 5 percent." As the debate delves into deficit implications, it is critical to consider that $1 trillion in new revenue for the federal government can be generated by four- tenths of a percentage in GDP growth.

Sophisticated economic models show the macroeconomic feedback generated by the TCJA will exceed that amount – more than enough to compensate for the static revenue loss.

We firmly believe that a competitive corporate rate is the key to an economic engine driven by greater investment, capital stock, business formation, and productivity – all of which will yield more jobs and higher wages. Your vote throughout the weeks ahead will therefore put more money in the pockets of more workers.

Supporting the Tax Cuts and Jobs Act will ensure that those workers – those beneficiaries – are American.

Sincerely,

James C. Miller III, Former OMB Director, 1985-88

Douglas Holtz-Eakin, American Action Forum

Alexander Katkov, Johnson & Wales University

Ali M. Reza, San Jose State U (Emeritus)

Ann E. Sherman, DePaul University

Anthony B. Sanders, George Mason University

Anthony Negbenebor, Gardner-Webb University

Arthur Havenner, University of California, Davis

Austin J. Jaffe, Penn State University

Barry W. Poulson, University of Colorado

Boyd D, Collier, Tarleton State University, Texas A&M University System (Emeritus)

Brian Stuart Wesbury, Joint Economic Committee

Carlisle E. Moody, College of William and Mary

Charles W. Calomiris, Columbia University

Christine P. Ries, Georgia Institute of Technology

Christopher C. Barnekov, FCC (Retired)

Christopher Lingle Universidad Francisco Marroquin

Clifford F. Thies, Shenandoah University

Daniel Fernandez Universidad Francisco Marroquin

Daniel Houser, George Mason University

David H. Resler, Chief US Economist, Nomura (Retired)

David Ranson, HCWE & Co.

Dennis E. Logue Steven Roth Professor, (Emeritus) Tuck School, Dartmouth Colleges

Derek Tittle, Georgia Institute of Technology

DeVon L. Yoho, Economist Ball State University (Retired)

Donald J. Oswald California State University, Bakersfield (Retired)

Donald Koch, Koch Investments

Donald L. Alexander, Western Michigan University

Donald Luskin, TrendMacro

Douglas C Frechtling, George Washington University

Douglas Kahl, The University of Akron

Douglas O. Cook, The University of Alabama

Kingdon Hurlock Jr., Calvert Investment Counsel

Edward M. Scahill, University of Scranton

Eleanor Craig, University of Delaware

Owen Irvine Michigan State University (Emeritus)

Farhad Rassekh, University of Hartford

Francis Ahking, University of Connecticut

Frank Falero, California State University (Emeritus)

Gary R. Skoog, Legal Econometrics, Inc.

Gary Wolfram, Hillsdale College

Gene Simpson, NPTC, Auburn University

George Langelett, South Dakota State University

Gerald P. Dwyer, Clemson University

Gil Sylvia, University of Georgia

H Daniel Foster, HDFCO

Hugo J. Faria, University of Miami

Inayat Mangla, Western Michigan University

Edward Graham, UNC Wilmington

Jagdish Bhagwati, Columbia University

James B Kau, University of Georgia

James C.W. Ahiakpor California State University, East Bay

James D. Adams, Rensselaer Polytechnic Institute

James D. Miller, Smith College

James F. Smith, EconForecaster, LLC

James Keeler, Kenyon College

James M. Mulcahy SUNY - Buffalo economics department

James Moncur, University of Hawaii at Manoa

Jeffrey Dorfman, University of Georgia

Jerold Zimmerman, University of Rochester

Jody Lipford, Presbyterian College

John A. Baden, Chm., Foundation for Research on Economics and the Environment (FREE)

John C. Moorhouse Wake Forest University (Emeritus)

John D. Johnson, Utah State University

John H McDermott, University of South Carolina

John McArthur, Wofford College

John P. Eleazarian, American Economic Association

John Ruggiero, University of Dayton

John Semmens, Laissez Faire Institute

Joseph A. Giacalone, St. John's University, NY

Joseph Haslag University of Missouri- Columbia

Joseph S. DeSalvo University of South Florida - Tampa

Joseph Zoric Franciscan University of Steubenville

Kathleen B. Cooper, SMU's John Tower Center for Politico Science

Kenneth V. Greene Binghamton University (Emeritus)

Lawrence Benveniste Goizueta Business School, Emory University

Lawrence R. Cima, John Carroll University

Leon Wegge, University of California, Davis

Lloyd Cohen, Scalia Law School

Lucjan Orlowski, Sacred Heart University

Lydia Ortega, San Jose State University

Northrup Buechner, St. John's University, New York

Maurice MacDonald, Kansas State University

Michael A. Morrisey, Texas A&M University

Michael Connolly, University of Miami

Michael D Brendler Louisiana State University Shreveport.

Michael L. Marlow, Cal Poly, San Luis Obispo

Moheb A. Ghali, Western Washington University

Nancy Roberts, Arizona State University

Nasser Duella, California State University, Fullerton

Nicolas Sanchez, College of the Holy Cross, Worcester, MA (Emeritus,)

Norman Lefton, Southern Illinois University, Edwardsville

Paul H Rubin, Emory University

Pavel Yakovlev, Duquesne University

Pedro Piffaut, Columbia University

Peter E. Kretzmer, Bank of America

Peter S. Yun, UVAWISE (Emeritus)

Phillip J. Bryson Brigham Young University (Emeritus)

Ashley Lyman, University of Idaho

L. Promboin, University of Maryland University College (former)

Richard J. Cebula, Jacksonville University

Richard Kilmer, University of Florida

Richard Timberlake, Prof. of Econ., Univ. of Ga. (Retired)

Richard Vedder, Ohio University

Robert B Helms, American Enterprise Institute (Retired)

Robert F Stauffer, Roanoke College , (Emeritus)

Robert H. Topel, University of Chicago Booth School of Business

Robert Heller, Former Governor, Federal Reserve Board

Robert Sauer, Royal Holloway University

Robert Tamura, Clemson University

Roger Meiners, University of Texas-Arlington

Sanjai Bhagat, University of Colorado Boulder

Scott Hein, Texas Tech University

Seth Bied, New York State Tax Department

Stan Liebowitz, University of Texas

Stephen Happel, Arizona State University

Craig Tapley, University of Florida

Thomas H. Mayor, University of Houston

Thomas J Kniesner, Claremont Graduate University

Thomas M. Stoker, MIT (retired)

Thomas Saving, Texas A&M University

Timothy Mathews, Kennesaw State University

Tomi Ovaska, Youngstown State University

Tony Lima, California State University, East Bay

Victor a Canto, La Jolla economics

Vijay Singal, Navrang Inc

Wallace Hendricks, University of Illinois

Ward S. Curran Trinity College Hartford Connecticut (Emeritus)

Wayne T. Brough, FreedomWorks Foundation

William B. Fairley, Analysis & Inference, Inc.

William Buchanan, Valdosta State University

William McKillop, Resource Economics (Emeritus)

William R. Allen UCLA Department of Economics

William S. Peirce Case Western Reserve University

Wim Vijverberg, CUNY Graduate Center

Xuepeng Liu, Kennesaw State University

Yuri N. Maltsev, A.W. Clausen Center for World Business, Carthage College

###

Next Article Previous Article