Press Contact:

202-224-4515, Katie Niederee and Julia Lawless

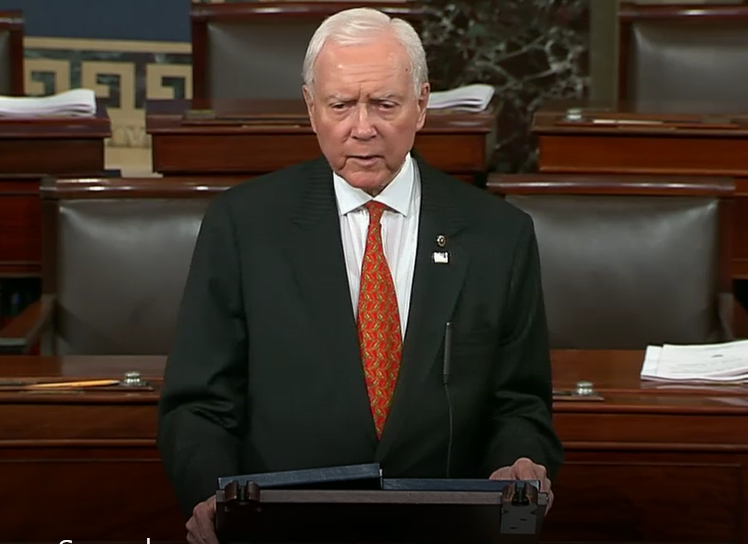

Hatch: Time to Deliver on Tax Reform

Utah Senator Highlights Start of Robust Legislative Process, Says, “We need to deliver [on tax reform] because the cost of doing nothing - the cost of maintaining the status quo for the foreseeable future - will be too much for the American people and our economy to bear.”

Click here to watch Chairman Hatch’s floor speech.

WASHINGTON – Senate Finance Committee Chairman Orrin Hatch (R-Utah) today highlighted the critical need to achieve comprehensive tax reform and the role the Senate Finance Committee will play in crafting legislation to create more jobs, bigger pay checks and increase economic growth.

On the need for tax reform: “Some have said that tax reform is a do or die moment for the GOP. I wholeheartedly believe that. Not just because we might lose an election, or that our poll numbers might go down…We need to deliver on that promise, and not just because we’ll suffer politically if we don’t. We need to deliver because the cost of doing nothing – the cost of maintaining the status quo for the foreseeable future – will be too much for the American people and our economy to bear.”

On the budget: “Make no mistake, the budget resolution is critical to our tax reform efforts. If we’re going to move a tax reform vehicle in the current environment, we need a resolution in place with a workable reconciliation instruction that will allow us to produce a bill of sufficient size and scope to give middle class taxpayers a pay raise, grow our economy, and create more American jobs…I am grateful to Chairman Enzi and all of our colleagues on the Budget Committee for their work in crafting the resolution, and I want to urge everyone who supports tax reform – whether they’re in Congress or elsewhere – to support the budget resolution.”

On partisan attacks: “There is simply no way for [the Tax Policy Center] or anyone to deliver these kinds of specific estimates with the information provided in the framework. To get their estimates, they filled in blanks with numbers from other proposals, added a pile of exceptionally pessimistic and biased economic assumptions, and came up with a tax plan that, for all intents and purposes, is their own. Just because they say this ‘analysis’ was performed on the unified framework and not just a plan they made up themselves doesn’t suddenly make their estimates credible.”

On process: “In the Finance Committee, we’re going to write a committee bill… We’re going to have a markup, where the bill will be debated and amended in the light of day. And, thereafter, I expect we’ll have a fair and open amendment process on the floor.”

On bipartisanship: “I want to work with anyone who is willing to come to the table in good faith. I think the framework puts forward a number of general proposals that both parties can support. There is fertile ground for bipartisanship here, if my Democratic colleagues are willing to set aside some of the unreasonable preconditions they’ve put on their involvement in tax reform. Last time I checked, both Republicans and Democrats supported tax relief for low- and middle-income families. Last time I checked, reducing our uncompetitive corporate tax rate was a bipartisan objective. And, last time I checked, both Republican and Democratic voters were in need of higher wages, more jobs, and a more competitive economy.”

Hatch’s full remarks can be found below:

Last week, I joined with the Secretary of the Treasury, the Director of the National Economic Council, our Senate Majority Leader, the Speaker of the House, and the Chairman of the House Ways and Means Committee in releasing a unified framework for tax reform.

This is a big step in the ongoing effort to overhaul our nation’s tax code.

I’ve been here in the Senate a while, and I can only remember a few times when the White House and House and Senate leadership were in agreement on an issue as complicated as tax reform. So, the current state of affairs is pretty remarkable.

Still, as we made clear in the framework document, this only a step, it is not a final product.

Now, the House and Senate tax-writing committees will be tasked with putting together legislation aimed meeting the goals and principles outlined in the framework. Therefore, as the Chairman of the Senate Finance Committee, my top goal at the moment is to produce a comprehensive tax reform bill that can get at least 14 votes in committee, because, without that, there likely won’t be any tax reform.

But, before we can get to that point, we need to pass the Fiscal Year 2018 Budget Resolution.

Make no mistake, the budget resolution is critical to our tax reform efforts. If we’re going to move a tax reform vehicle in the current environment, we need a resolution in place with a workable reconciliation instruction that will allow us to produce a bill of sufficient size and scope to give middle class taxpayers a pay raise, grow our economy, and create more American jobs.

As we all know, the Budget Committee will begin marking up their resolution later today and it includes the type of instruction we need to produce a bill that will fix our broken tax system, boost economic growth, and give a pay raise to middle-class Americans.

I am grateful to Chairman Enzi and all of our colleagues on the Budget Committee for their work in crafting the resolution, and I want to urge everyone who supports tax reform – whether they’re in Congress or elsewhere – to support the budget resolution.

Once again, that is the next big step in this process, and it is absolutely essential.

Once that’s done, the Finance Committee will be able to move forward on crafting and marking up a tax reform bill.

Some have said that tax reform is a do or die moment for the GOP.

I wholeheartedly believe that. Not just because we might lose an election, or that our poll numbers might go down.

Republicans have promised for some time now that we will deliver meaningful, comprehensive tax reform that will spur economic growth, increase wages, add well-paying jobs, and simplify our existing system.

We need to deliver on that promise, and not just because we’ll suffer politically if we don’t.

We need to deliver because the cost of doing nothing – the cost of maintaining the status quo for the foreseeable future – will be too much for the American people and our economy to bear.

The last major overhaul of our tax code was 31 years ago. And, in many respects, our current tax system was built for the economy of 1986 and is ill-suited for the needs of today.

In the last 31 years, we’ve seen a dramatic increase in international trade and expanded globalization.

We’ve seen the fall of the Soviet Union and the collapse of most centrally-run economies.

And, of course, we’ve seen the development and rapid expansion of the Internet, which has, in many respects, remade the entire world several times over.

America no longer has a competitive tax code. Instead, we have a byzantine system with exceptionally high rates and an array of overlapping and often less-than-effective deductions, exclusions, and credits.

This isn’t just a parade of horribles trotted out by Republicans. These problems have been acknowledged by a number of prominent Democrats, like Presidents Clinton and Obama, not to mention our current Senate Minority Leader and the Ranking Member of Finance Committee, Senator Wyden.

We all know that the system isn’t working.

Still, in many respects, we have politics as usual around here when we talk about tax reform.

While both parties have supported reforms in the recent past – including a number of reforms included in the framework – we’re already hearing the same tired arguments that come up every time Republicans want to talk about tax reform.

According to the opponents of reform, our “plan” will cut taxes on the super-rich.

Our “plan” will raise taxes on the poor.

Our “plan” will harm the middle class.

Our “plan” is a giveaway to greedy corporations.

These are some pretty odd claims given that, as of right now, no completed “plan” exists. We have a framework, and we’re not calling it that simply for PR reasons. We have some basic principles and targets that leaders have agreed upon, but, as framework makes clear, the Finance and Ways and Means Committees have been tasked with filling in the details and writing legislation.

Here are just some of the details NOT included in the framework:

Income thresholds for individual tax brackets – the framework includes rate targets for three brackets, but the breakdown of those brackets is still to be determined.

The size of the enhanced child tax credit – the framework anticipates an increase, but it doesn’t specify an amount.

The existence and rate of the highest bracket – our document leaves room for the creation of a fourth bracket at the high end, but it doesn’t include any rate target.

Safeguards to prevent abuse of the separate pass-through rates.

These are just some of the key details that need to be filled in. My point is that no one can make any definitive statements or make any credible estimates about the fiscal impact of the plan until the committees do more work.

Still, that hasn’t stopped people from trying.

Last week, the left-leaning Tax Policy Center released an unattributed “analysis” of the framework that appeared to confirm a number of blanket claims critics have made about our “plan.”

As we all know, left-leaning pundits, liberal media outlets, and many of our friends on the other side seem to love the TPC, apparently because the TPC is willing to provide estimates and “analysis” about tax plans without waiting for all the boring details.

We all remember well when TPC wrote Mitt Romney’s tax plan for him and claimed he wanted to raise taxes on the middle class to finance a tax cut for the top one percent. Their “analysis” of the Romney plan – a plan that was not yet in existence beyond a broad set of principles – became the gospel for our friends on the other side and their estimates were repeated time and again, never mind the fact that they didn’t have nearly enough evidence to support them.

The TPC appears to be on the same track with regard to the unified framework.

The TPC document from last week included a relatively precise estimate of lost revenue that they claim would result from the framework.

It also estimated how much of the tax benefit of the framework would go to the top 1 percent of earners, again with a fair amount of precision.

How they got to these results is a mystery.

There is simply no way for TPC or anyone to deliver these kinds of specific estimates with the information provided in the framework. To get their estimates, they filled in blanks with numbers from other proposals, added a pile of exceptionally pessimistic and biased economic assumptions, and came up with a tax plan that, for all intents and purposes, is their own. Just because they say this “analysis” was performed on the unified framework and not just a plan they made up themselves doesn’t suddenly make their estimates credible.

Still, I expect to hear a lot about the TPC “analysis” in the coming weeks. Some will treat their estimates as fact and I expect we’ll see them cited in a few campaign commercials before too long.

Breaking from any notion of professional accountability, the TPC “analysis” was, according to TPC’s report, authored by TPC staff. Evidently, no one in an organization that describes itself as “nonpartisan” wanted to put their name on a document that would be used in such a partisan manner.

But, let’s be clear, Mme. President, we can’t separate this kind of speculative “analysis” from the way it’s being used by our friends on the other side. It has become fodder for more of the same partisan attacks.

Going forward, I hope that TPC – and other think tanks – will acknowledge the still-undefined features of the framework, including the commitment to maintaining the current progressivity of the tax code, which will require adjustments in order to achieve. I think groups like TPC can be helpful if they avoid the partisan criticisms and focus on shedding light and providing accurate assessments of various proposals.

Everyone who has an interest in these issues should wait and the let the tax writing committees do their work.

In the Finance Committee, we’re going to write a committee bill. Any member who is sincerely interested in working with us will get a chance to contribute, whether they are Republican or Democrat.

We’re going to have a markup, where the bill will be debated and amended in the light of day. And, thereafter, I expect we’ll have a fair and open amendment process on the floor. Despite some odd claims to the contrary, the Joint Committee on Taxation will score the bill.

At the end of the day, people will be free to disagree with the final bill and vote against it. But, no one will be able to credibly claim that the legislation was written behind closed doors or that the American people didn’t get a chance to see what was in the bill and read accurate accounts of its fiscal and economic impact.

I want to work with anyone who is willing to come to the table in good faith. I think the framework puts forward a number of general proposals that both parties can support. There is fertile ground for bipartisanship here, if my Democratic colleagues are willing to set aside some of the unreasonable preconditions they’ve put on their involvement in tax reform.

Last time I checked, both Republicans and Democrats supported tax relief for low- and middle-income families.

Last time I checked, reducing our uncompetitive corporate tax rate was a bipartisan objective.

And, last time I checked, both Republican and Democratic voters were in need of higher wages, more jobs, and a more competitive economy.

This is going to be a difficult process, whether it’s bipartisan or partisan. There is a long list of sacred cows in our tax code, each of them with a constituency that will fight to keep them in place.

We’re going to have to eliminate a number of tax deductions and credits if we’re going to be fiscally responsible, including a number of provisions that are, under the current system, pretty popular in certain segments of the country.

The framework specifies two deductions that should stay in place, because they benefit many in the middle class and they are designed to achieve important policy goals. Everything else is currently on the table, including items that I have personally championed in the past.

We’ve already seen stories about how Republicans are already divided on the fate of the state and local tax deduction. Make no mistake, that’s a pretty popular deduction, particularly among Democrats, but it has some Republican supporters as well.

I would remind my colleagues who are adamant about preserving the state and local tax deduction that the benefits of that particular provision skew heavily toward higher-income earners, especially those living in high-tax cities and states. So, if our main goal is to help the middle class, I would hope that there won’t be many senators who will fall on their swords in order to keep this particular deduction in place.

Still, nothing is set in stone and most items are currently still up for negotiation. The state and local tax deduction is, like virtually every other tax provision, currently on the table and we may very well have to pare it back one way or another. We need to see how the numbers work out before we can speak definitively on this or any other tax policy item.

Before I conclude, Mme. President, let me just say that this is a once-in-a-generation opportunity. There is currently more momentum in favor of tax reform than at any other time in the past three decades. All of us should be willing to take advantage of this opportunity.

###

Next Article Previous Article