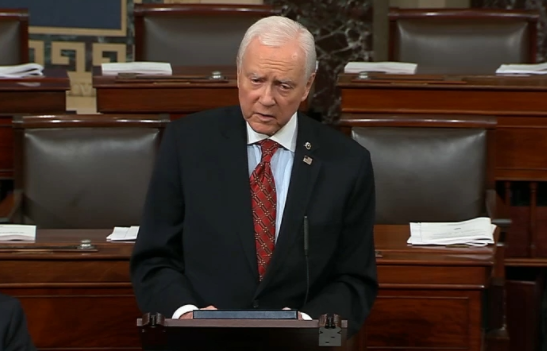

Hatch on Tax Overhaul: Important, Far-Reaching, Historic

Finance Committee Chairman Speaks on Senate Floor in Favor of Tax Reform

CLICK HERE to watch Hatch’s tax reform speech.

WASHINGTON – Finance Committee Chairman Orrin Hatch (R-Utah) today spoke on the Senate floor in favor of the tax reform conference committee report. This sweeping legislation will cut taxes for middle-class families, grow the economy, and boost investment at home.

"I’ve been party to a number of major legislative achievements,” Hatch said on the Senate floor. “The legislation before us is as important and far-reaching as anything I’ve been privileged to work on. It is beyond gratifying to see the Senate reach this point, and I look forward to finally seeing real tax reform legislation signed into law. Passage of this important bill will be historic— the culmination of years of work by people in both parties, in both chambers, and on both sides of Pennsylvania Avenue. Many of us in this body have been waiting years for this opportunity. And millions of Americans outside of this body have been waiting even longer.”

Hatch delivered the following remarks:

Mr. President, the Senate will soon vote on the conference report for H.R. 1, the Tax Cuts and Jobs Act.

I have waited a long time to be able to give this final statement in support of tax reform legislation.

As you know, Mr. President, I’ve been in the Senate for a little while.

I’ve been party to a number of major legislative achievements, like the passage of the Americans with Disabilities Act, the creation of the CHIP program, and the Religious Freedom Restoration Act, to name just a few.

The legislation before us is as important and far-reaching as anything I’ve been privileged to work on. It is beyond gratifying to see the Senate reach this point, and I look forward to finally seeing real tax reform legislation signed into law.

Passage of this important bill will be historic— the culmination of years of work by people in both parties, in both chambers, and on both sides of Pennsylvania Avenue.

Many of us in this body have been waiting years for this opportunity. And millions of Americans outside of this body have been waiting even longer.

It’s no secret, Mr. President, that our tax code is broken. Members of both parties have acknowledged this. If you walked across the country and asked Americans of all backgrounds and ideologies, you wouldn’t find many who would be willing to defend the status quo.

There is one apt phrase my good friend Senator Wyden uses to describe our tax code: he calls it “a dying carcass.”

Indeed, our tax code is dying, and rotting.

It has hampered job creation, wage growth, investment in the United States, and has chased American companies to foreign shores.

It has also given foreign companies a leg up on U.S. businesses in the global marketplace, leading to a record number of foreign takeovers and inversions.

The bill before us will address these problems and help us turn the ship around.

Our legislation will reduce the corporate tax rate to 21 percent. The lowest level in the modern history of the United States, placing our country slightly below the average of industrialized countries. These changes will once again give American companies a competitive edge and bring more business back home.

Hundreds of economists have said that our bill will boost economic growth. And, numerous companies have indicated that, once our bill becomes law, they will invest heavily in expansion and job creation right here in the United States.

In addition, as the Joint Committee on Taxation has made clear, reducing the corporate tax rate has distributional effects that go beyond the companies themselves, their high-ranking officers, or even their richest shareholders.

In fact, JCT estimates that workers bear 25 percent of the corporate tax rate and other economists have found that this number can reach as high as 75 percent—this means no matter how you slice it, Americans will see their wages go up when corporate tax rates go down.

Further, over the last few decades, we’ve seen a massive expansion of pension and retirement assets, much of which are invested in corporate stocks. While many of my colleagues like to decry any business for merely earning a profit, the truth of the matter is that the continued rise of corporate profits has significantly expanded the wealth of middle-class workers and taxpayers who have continually set aside funds for the future.

A representative from the Tax Policy Center testified before the Finance Committee in the spring of last year. At that hearing, he stated that 37 percent of corporate stock ownership was held in retirement plan accounts. That was the largest share of overall stock ownership. And that statistic syncs-up with the distribution tables put out by the non-partisan Joint Committee on Taxation.

For all these reasons, lowering the corporate tax rate has been a bipartisan goal for over a decade now. I’ve said it before: Presidents Clinton and Obama, Senators Wyden and Schumer, and most of the other Democrats on the Senate Finance Committee have, at some point in the recent past, endorsed a significant

reduction in the U.S. corporate tax rate.

Our bill will achieve this bipartisan goal, and place our country well within the mainstream among our international competitors.

This is a good thing, Mr. President. Not just for businesses and rich stockholders, but for working, middle-class families as well.

And, let’s be clear: This bill’s chief focus is about helping the middle class.

I know there’s a tendency among some in this chamber to act and speak as though all money in this country inherently belongs to the government. I won’t speak for everyone, but those of us who have worked on this bill tend to think differently.

Aside from business reforms that will grow our economy, increase wages, and create jobs, our bill will lower individual tax rates across the board, allowing hardworking Americans to keep more of their money.

In our bill, we also nearly double the standard deduction for individuals and married couples. This feature will significantly reduce the burden of tax filing for millions of middle-class families and decrease even further the overall tax liability of millions more.

For the first time in more than 30 years, nearly every American will get more money back by just filling out an EZ form. This, without a doubt, fulfills our goal of simplifying the tax code.

For individuals who are concerned about being able to itemize – again, we believe the number of people with this concern will decrease dramatically under our bill – we retain a number of key provisions that benefit many in the middle class.

For example, this historic legislation will allow individuals and families to continue to claim deductions for state and local taxes, up to $10,000 a year.

It will keep in place, with relatively minor adjustments, the deduction for mortgage interest.

And, Americans who itemize and want to deduct their charitable contributions will be free to do so.

We are also expanding the child tax credit with this bill, doubling it from $1,000 to $2,000 and making the credit far more refundable than ever before.

The adoption credit will stay in place.

The deduction for medical expenses will still be available.

Credits and assistance for students and their families will be untouched.

We’ve made all of these changes and, when necessary, preserved current law, with an eye toward helping the middle class.

I know a number of my colleagues like to argue that this bill will have different results. So, let’s look at the numbers.

Under this bill, a typical family of four, earning the median family income of $73,000, will see their taxes go down by more than half – about 58 percent.

Mr. President, that number means something more than just a simple percentage; it means that an average American family will be able to keep $2,058 more of their own earnings next year.

That’s a mortgage payment, a down payment for a car, or several months-worth of groceries.

What about a single parent?

Under our plan, a single parent with one child, making $41,000, will see their taxes slashed by nearly 73 percent – that’s almost a three-quarter reduction in tax liability.

That means a savings in more than $1,300 over the course of a year. That could be a month of day-care expenses, multiple car payments, or a family vacation.

These are things that matter to American families, Mr. President. And they well should.

But our friends on the other side have been so caught up in partisan politics that they’ve decided to ignore the Americans who will benefit from this legislation.

I think it started with the election of President Trump and the retention of Senate control by Republicans. Their base protested, occupied, and disrupted the transfer of power from President Obama to President Trump.

Here on the Hill, the “resistance” was in full effect right off the bat, with a coordinated effort to stall nominations in committee, which included unprecedented boycotts and refusals to meet with nominees.

And it has only gone downhill from there.

So while we heard words from our friends on the other side about participating in tax reform, their actions showed otherwise. Unprecedented process demands were made. Resistance was the plan, and that plan was carried out.

Now, we hear about massive tax cuts for the very rich and huge breaks for corporations.

But, these claims fall apart when you look at the facts.

Again, this isn’t uncharted territory for my friends on the other side. Accusing Republicans of hating the poor and loving the rich is one of their go-to moves. But I do think they’re getting more desperate and vicious in their attacks because they regret their own decisions to sit out of this endeavor.

And, that’s precisely how it happened, Mr. President. Our colleagues were apparently so preoccupied with denying President Trump and congressional Republicans any success that they chose not to engage and, instead, to sit in the peanut gallery throwing out baseless attacks.

As I’ve said literally dozens of times over the past few years, I wish that the Democrats had joined us in this process, put aside their ultimatums and preconditions, and helped to advance policies that they’ve claimed to support for years now.

But we are where we are, and while the bill before us includes a number of ideas and proposals Democrats have supported, we are prepared to pass it without their votes.

Once again, this is a historic bill, Mr. President. I’m proud of the work we’ve done on the Finance Committee, here on the floor, and in conference to get us to this point. And I again invite my friends on the other side to also support the bill.

I’m proud of our colleagues who have put in so much effort to get us here.

And, I’m proud of the staff who have labored day and night to assist in this endeavor.

Like I said, Mr. President, this legislation has been years in the making.

I urge all of my colleagues to support the conference report and help us send it to the president’s desk. You won’t regret it.

###

Next Article Previous Article