Press Contact:

202-224-4515, Katie Niederee and Julia Lawless

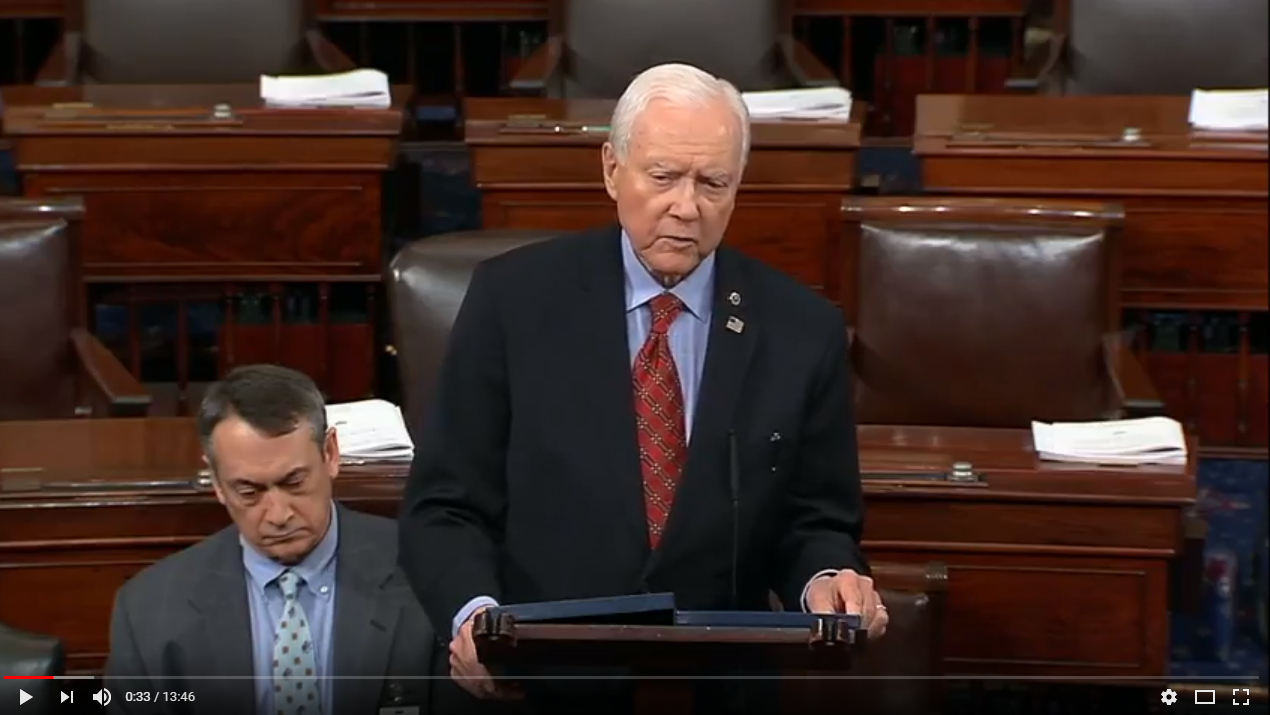

Hatch Highlights Tax Reform Success on Senate Floor

Finance Committee Chairman Thanks Staff for Critical Work on Tax Bill

Click Here to Watch Hatch Speak on Tax Reform

Finance Committee Chairman Orrin Hatch (R-Utah) spoke on the Senate floor today following the historic passage of the first comprehensive tax overhaul in more than 30 years, emphasizing all of the hard work that went into crafting the legislation.

Hatch delivered the following remarks:

Mr. President, with this week’s passage of the Tax Cuts and Jobs Act, many throughout the country are rightly celebrating the first substantive reform of our nation’s tax code in more than three decades. While the popular narrative surrounding this bill has been that Congress has moved quickly to pass this legislation, I don’t think anyone who has worked on tax reform over the last several years would agree with that assessment.

This week’s success was made possible by years of hard work and the efforts of countless policymakers, experts, advocates, and public servants.

Over the last several years, I’ve come to the floor on many occasions to advocate for tax reform. I’m glad today to be able to rise and acknowledge the efforts of many people whose work made the historic occasion possible.

First, I’d like to thank those members who went before us. Former Chairmen Camp, Grassley, and Baucus spent the better part of a decade laying the groundwork for this effort.

I also want to thank Senator Wyden, who, along with Chairman Baucus, worked with me on the Finance Committee over the past several years as we produced reports and options papers, convened bipartisan working groups, and held more than 70 hearings to discuss tax policy.

While I have been disappointed that my Democratic colleagues have opted to not participate in this year’s efforts to produce this particular bill, they definitely contributed to the knowledge and policy base we worked from to put our legislation together.

For years I’ve reiterated the importance of presidential leadership when it comes to tax reform.

I am grateful that President Trump has been willing to engage with Congress on this issue and to put some political skin in the game in order to move us forward. From the outset of this administration, Secretary Mnuchin and Director Cohn have been actively working to make this success a reality. I want to thank them for their engagement in this effort and the work they and their staffs have put in.

From the Treasury staff, I’d like to thank Justin Muzinich, Dan Kowalski, and Jay Mackie.

From Director Cohn’s staff at the National Economic Council, I need to thank Jeremy Katz and Shahira Knight.

And, from the White House, thanks to Marc Short, Amy Swonger, Andy Koenig, Joseph Lai, and Jim Goyer.

These staffers from the administration worked for the better part of a year with leaders from both chambers to produce this bill and get it over the finish line. Their success is shared with our colleagues over in the House, led by Chairman Brady and Speaker Ryan. I thank my colleagues for their work and their willingness to find common ground when many believed that it was impossible to do so.

From the Ways and Means staff, I want to thank David Stewart, Matt Weidinger, Allison Halataei, Rick Limardo, and Paul Guaglianone, with special thanks owed to the committee tax staff: Barbara Angus, Aharon Friedman, John Sandell, Victora Glover, John Schoenecker, Randy Gartin, Aaron Junge, Donald Scheider, Danielle Dubose, and Kathryn Chakmak.

From the Speaker’s office, I want to thank Jonathan Burks, Austin Smythe, George Callas, Derrick Dockery, and Josh Althouse.

And, and from the House Majority Whip’s office, I need to thank both Marty Reiser and Kelly Hudak.

Of course, here in the Senate, we have been ably led by the Majority Leader. I want to thank Senator McConnell for his commitment to get this done and for his leadership throughout this entire endeavor.

And, from the Leader’s staff, I want to thank Sharon Soderstrom, Brendan Dunn, Antonia Ferrier, Hazen Marshall, Erica Suares, Terry Van Doren, Don Stewart, and Jane Lee.

Joining Senator McConnell, as always, has been our distinguished Majority Whip. I thank Senator Cornyn for his efforts in shoring up support and addressing our members’ concerns from the beginning of this process up until final passage of the conference report.

From the Whip’s staff, I want thank Monica Popp and Sam Beaver.

Of course, when it came time to draft the Senate’s tax reform legislation, most of the real work was done in the Finance Committee. The committee bill was truly a shared product that included the input and addressed the interests of every majority member on our dais.

Without their work, we wouldn’t have had a bill. And, without their commitment to seeing this through, we wouldn’t have gotten to where we are. I want to thank Senators Grassley, Crapo, Roberts, Enzi, Cornyn, Thune, Burr, Isakson, Portman, Toomey, Heller, Scott, and Cassidy for the months of work they put into producing and passing this legislation.

I also need to thank their staffs who, up until this week, hadn’t slept in months.

My thanks also go out to the tax staffers on the committee, namely, Chris Allen, Joseph Boddicker, Chris Conlin, Shay Hawkins, Randy Herndon, Bart Massey, Monica McGuire, Mike Quickel, Zachary Rudisill, Andrew Siracuse, Robert Sneeden, Derek Theurer, and Mark Warren.

And, thanks to the committee’s legislative directors: Charles Cogar, Ken Flanz, Chris Gillott, Brad Grantz, Amber Kirchhoefer, Kurt Kovarik, Jessica McBride, Sarah Paul, Landon Stropko, Jay Sulzmann, Stephen Tausend, Pam Thiessen, and Christopher Toppings.

Of course, when the Democrats signaled their refusal to even meet on tax reform, we knew that we’d need a well-crafted budget resolution with the right instructions to get tax reform passed.

So, I need to thank Chairman Enzi and the Budget Committee for their work, which made a seemingly mundane and tedious process look easy.

From the Budget Committee staff, I want to thank Joe Brenckle, Jim Neill, Betsy McDonnell, Matt Giroux, Paul Vinovich, Becky Cole, Eric Ueland, Steve Townsend, Jeremy Dalrymple, and Thomas Fueller.

Once we had a resolution, we had to hold a markup. And, in the Finance Committee, that can be a challenging process, particularly on a bill this big and complex.

Thankfully, we’ve been ably served by a professional staff who helped us through that whole process, namely Joshua Levasseur, Jewel Harper, Joe Carnucci, Mark Blair, Athena Schritz, Susanna Segal, Eliza Smith, Tim Corley, and Michael Pinkerton.

The Joint Committee on Taxation was also critical throughout the committee process, as well as when we moved the bill onto the floor. They worked countless hours doing work that often just made everybody mad at one point or another. Theirs is an often thankless but critical job, and I am grateful for their dedication and earnestness. Specifically, I need to thank Tom Barthold and his team for making sure both parties in the House and Senate were getting all of the information we needed—at times under challenging time constraints.

And, after moving a mark through the committee, we relied on assistance from the Senate Legislative Counsel’s office to put together the legislative text. That was a critical step, and we could not have done it without Mark McGunagle, Jim Fransen, and their team.

Then as we began to prep the bill for the floor, we spent countless hours debating different provisions before the Parliamentarian. This process can be difficult, and I want offer my thanks to our Parliamentarian, Elizabeth MacDonough, and her team for the hours and days they put in to helping us comply with the rules of the Senate.

As the bill neared its final phase, we were grateful to be able to work with Senator Murkowski on the second title of the bill, and as we moved to conference committee, Senator Murkowski’s counterparts in the House also played an instrumental role in helping to finalize this legislation.

And, of course, there are those who work hard to make sure things go smoothly here on the floor. I want to thank the majority floor staff for their assistance, particularly Laura Dove, Robert Duncan, and Megan Mercer.

Like I said, Mr. President, this has been a long process. And, throughout this entire venture, I have had the benefit of working with a skilled and committed staff. My staff have sacrificed time, energy, sleep, and, in some cases, likely their physical and mental health, to the passage of this bill. It has been an incredible effort and I need to thank all of them.

I want to single out my Chief Tax Counsel, Mark Prater. I think everyone in this chamber – and everyone in Washington – would agree that we could not have done any of this without Mark.

I also need to thank my Staff Director, Jay Khosla, who has been the tip of the spear, managing the incoming and outgoing issues with apparent ease. I also want to thank his assistant, Jason Stegmaier, for helping keep Jay from forgetting the important details, like remembering to eat lunch.

I want to thank my entire tax staff: Jennifer Acuña, Tony Coughlan, Christopher Hanna, Alex Monié, Eric Oman, Marty Pippins, Preston Rutledge, and Nick Wyatt.

I need to thank the members of my senior team as well: Matt Hoffmann, Jeff Wrase, Julia Lawless, Jennifer Kuskowski, Chris Armstrong, Bryan Hickman, and Shane Warren. And, thank you to my communications staff on the committee: Katie Niederee, Nicole Hager, and Joshua Blume.

I also want to thank a couple of former Finance Committee staff members, specifically Chris Campbell, my former Staff Director, who helped to set the stage for this entire effort, and Jim Lyons, my tax counsel who passed away last year. He spent years working on tax reform and I know we all wish he could be here to celebrate with us this week.

From my personal office staff, I want to thank my legislative assistant James Williams and Matt Sandgren, my Chief of Staff.

There are many more people who deserve thanks this week. Far too many to mention. They are not forgotten, believe me.

We’ve done a good thing here this week, Mr. President. This is truly a historic success.

Some of our colleagues on the other side last night said that the American people will remember what happened here this week. To that, all I can say is that I hope they do. This new tax law will do a lot of good for a great number of people throughout our country. And, I am humbled to have been a part of the efforts of so many people who were willing to get this done for the American people.

###

Next Article Previous Article