Press Contact:

202-224-4515, Katie Niederee and Julia Lawless

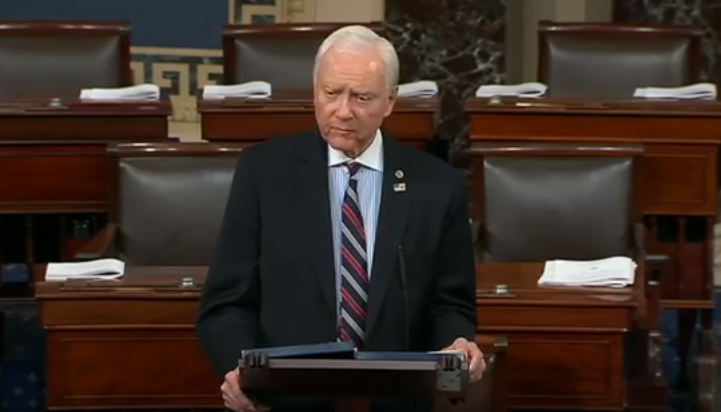

Hatch: Budget Resolution Key to Meaningful Tax Reform

Utah Senator Says, “As the debate over the budget and the instruction moves forward, I think it is critical that everyone understand what tax reform will do for our country and, perhaps more importantly, what will happen if we fail.”

WASHINGTON – In a speech on the Senate floor today, Finance Committee Chairman Orrin Hatch (R-Utah) discussed the importance of passing a budget resolution for Fiscal Year 2018 and thanked Senate Budget Committee Chairman Mike Enzi (R-Wyo.) for his work on the resolution. Hatch emphasized that the budget’s $1.5 trillion instruction to the Finance Committee will be key to meaningful tax reform.

“As the debate over the budget and the instruction moves forward, I think it is critical that everyone understand what tax reform will do for our country and, perhaps more importantly, what will happen if we fail,” Hatch said. “Tax reform has been the chief focus of Senate Finance Committee for years now. In the six and a half years I’ve been the lead Republican on the committee, we’ve had about 70 hearings focused on the tax code. In the vast majority of those hearings, we have heard both Democrats and Republicans acknowledge the inefficiency of our current tax system.”

Hatch continued, “Don’t get me wrong, I would like to produce a tax reform product that could get 60 votes…Under President Trump, the focus, at least among many in the Democratic leadership, seems to be about preventing passage of anything that could be viewed as a win for the president and Republicans in Congress…There are number of areas of tax reform where Democrats and Republicans are largely in agreement. Those areas include: middle-class tax relief, bringing down the corporate rates and fixing our international tax system to make American companies more competitive.”

The complete speech as prepared for delivery is below:

Mr. President, this week, the Senate will vote on a budget resolution for Fiscal Year 2018.

While there are many elements to this particular resolution, most of this chamber’s and the public’s attention are on the reconciliation instructions related to tax reform.

Before I go too far, I first want to thank Chairman Enzi and all of our colleagues on the Budget Committee for their work on this resolution. Chairman Enzi has been a critical player in the ongoing effort to reform our broken tax code and his work to craft this budget resolution and move it out of committee has been critical to this effort.

For the next step, he’s going to need help passing the resolution here on the floor. I think we’ll get there.

Specifically, this budget resolution contains a $1.5 trillion reconciliation instruction for tax reform. That is a good number, putting meaningful tax reform within reach.

As the debate over the budget and the instruction moves forward, I think it is critical that everyone understand what tax reform will do for our country and, perhaps more importantly, what will happen if we fail.

Tax reform has been the chief focus of Senate Finance Committee for years now. In the six and a half years I’ve been the lead Republican on the committee, we’ve had about 70 hearings focused on the tax code.

In the vast majority of those hearings, we have heard both Democrats and Republicans acknowledge the inefficiency of our current tax system. With very few members having spent their time and energy defending the status quo. Which is not at all surprising.

Our current tax system imposes undue burdens on middle class families.

Our current tax system is obscenely complex, riddled with credits, exemptions, and deductions, many of which were designed to benefit special interests.

Our current tax system’s complicated rate structure makes it difficult for families to plan and, for some workers, creates a disincentive to work for additional earnings.

Our current tax system subjects American businesses and job creators to the highest tax rates in the industrialized world.

Our current tax system creates incentives for businesses to move headquarters and operations offshore, eroding our nation’s tax base.

And, our current system has forced companies to keep trillions of dollars offshore, preventing further investment and growth here at home.

Reform to this broken system is long overdue.

The last major overhaul to our tax code was more than three decades ago. Even if the tax code hadn’t changed dramatically since that time, the economy of 1986 was dramatically different from the one we have today. Of course, the code has undergone a number of piecemeal changes since the 1986 reform, but that approach has left us with a system that simply does not work.

Fundamental change is what our tax system needs. Change that takes the entire system into account and change that will create a tax code that, at the very least, looks like it was designed on purpose.

That’s what we aim provide once the Senate and the House have passed a consensus budget resolution.

On the Finance Committee, we’re working to craft legislation pursuant to the guideposts in the unified framework released last month.

Our bill, based on the unified tax reform framework, will give much-needed relief to millions of low-to-middle income families.

It will level the playing field for American job creators and promote more investment in the United States.

In the end, all of this will mean bigger paychecks for American workers, a more vibrant U.S. economy, and more American jobs.

But, without this budget resolution, Mr. President, we’re unlikely to get there.

Don’t get me wrong, I would like to produce a tax reform product that could get 60 votes. I’ve spent years asking my Democratic colleagues to meaningfully engage in this effort.

To be sure, there have been Democrats who have been willing to put themselves out there on tax reform in recent years, including former Finance Committee Chairman Max Baucus and our current ranking Member, Senator Wyden. But, they have generally been the exception.

When President Obama was in office, many Democrats typically only talked about tax reform in the context of raising revenues to fuel additional spending, which isn’t tax reform at all—it’s simply raising taxes.

Under President Trump, the focus, at least among many in the Democratic leadership, seems to be about preventing passage of anything that could be viewed as a win for the president and Republicans in Congress. Perhaps I’m wrong about that – and I hope I am – but, when we’re talking about tax reform these days, most of the talk from my friends on the other side of the aisle has been about unreasonable and unprecedented process demands.

That’s unfortunate, Mr. President. There are number of areas of tax reform where Democrats and Republicans are largely in agreement. Those areas include: middle-class tax relief, bringing down the corporate rates and fixing our international tax system to make American companies more competitive.

Given these shared concerns, I am still hopeful that some of our Democratic colleagues will join us in this effort. And, I remain willing to work with any member of the Senate who wants to engage in this effort in good faith.

Historically speaking, tax bills that pass through the budget reconciliation process tend to have support from both parties. In fact, when Republicans have held the White House and Congress, purely partisan tax reconciliation bills have not been enacted. That being the case, I think the unified framework envisions a tax reform approach that both parties can and should support.

Long story short, I haven’t given up on producing a bipartisan tax reform package.

But, once again, we need to pass this budget resolution if we’re going to move the ball forward.

That being the case, I urge my colleagues to support the resolution before us this week and to work with us as we develop tax reform legislation that will help middle class families and job creators throughout the country.

With that, Mr. President, I yield the floor.

###

Next Article Previous Article