Press Contact:

202-224-4515, Julia Lawless and Katie Niederee

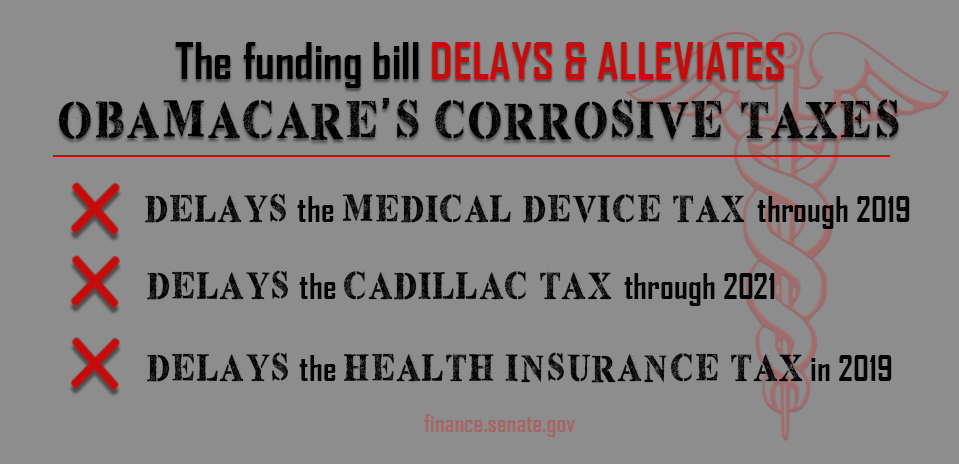

Dismantling Obamacare Bit-by-Bit

Last year’s historic tax overhaul not only included the biggest rewrite of our nation’s tax code in over 30 years, but it also took a large stride toward dismantling Obamacare by repealing the punitive and regressive individual mandate tax.

This week, Congress took another step in unwinding Obamacare by delaying three of its most egregious taxes: it delays the medical device tax through 2019, the Cadillac tax through 2021 and the Health Insurance Tax (HIT) in 2019. Hatch has long advocated that these taxes should be repealed in their entirety. In fact, Hatch successfully secured delays for these taxes when Congress passed the PATH Act in 2015, which he authored.

Here’s a look at how the bill deals a blow to Obamacare:

Delays the Medical Device Tax through 2019: Under Obamacare, manufacturers of medical devices are required to pay a 2.3 percent excise tax on products ranging from surgical tools to rubber gloves. This tax reduces resources to create and retain jobs and invest in product development, costing nearly 29,000 jobs in the medical technology industry and hampering innovation, critical to developing life-saving and life-improving medical technology. The Medical Device Tax has been criticized by members of both parties and delaying it helps American consumers and patients.

Delays the Cadillac Tax through 2021: The Affordable Care Act (ACA) also imposed a 40 percent tax on high cost employer-sponsored health insurance, known as the Cadillac tax, making insurance more expensive for employees and adding another level of red-tape for employers. Repealing this tax has also received broad, bipartisan support.

Delays the Health Insurance Tax in 2019: The ACA also created a new tax on health insurance premiums, which according to the Congressional Budget Office (CBO) will be “largely passed through to consumers in the form of higher premiums.” Delaying this tax will protect consumers from the higher premiums caused by HIT in 2019.

###

Next Article Previous Article