Press Contact:

Katie Niederee and Julia Lawless, 202-224-4515

Breaking Down Section 232 of the Trade Expansion Act of 1962

Fast Facts on Steel and Aluminum Tariffs and the Auto Imports Investigation

What exactly is Section 232?

Section 232 of the Trade Expansion Act of 1962 allows the head of any executive branch department or agency to request a Department of Commerce (DoC) investigation into the effects of specific imports on the national security of the United States. If DoC finds and the president agrees that the imports threaten our national security, the president is authorized to take action to adjust the level of imports. Such action may include altering tariffs – the tax that American importers must pay to bring overseas goods into the United States – or imposing quotas, which limit the volume of a product that Americans may bring into the country.

How often do Section 232 investigations occur?

Section 232 investigations rarely occur, and only two prior investigations have led the president to restrict imports: in 1979 and 1982, the president imposed an embargo blocking imports of crude oil from Iran and Libya, respectively. The most recent Section 232 investigation, in 2001, concerned imports of finished steel and iron ore, and resulted in the DoC determining that they did not threaten to impair national security.

How has the Trump administration used this authority?

In April 2017, Commerce Secretary Wilbur Ross initiated, on his own, a Section 232 investigation into imported steel and aluminum products.

The result?

Secretary Ross concluded that steel and aluminum imports threaten to impair national security and recommended that the president impose tariffs and/or quotas to remove that threat. The president agreed, and in March 2018 imposed a 25 percent tariff on certain steel products and a 10 percent tariff on certain aluminum products, subject to temporary exemptions for products from some countries.

What's the impact on Americans who rely on steel and aluminum products from overseas?

As of June 1, the 25 percent tariff applies to imported steel products from all countries except Argentina, Australia, Brazil and South Korea. Imported steel products from Argentina, Brazil and South Korea are subject to quotas that prohibit any imports above the quota levels.

And, as of June 1, the 10 percent tariff applies to imported aluminum products from all countries of origin except Argentina, Australia and Brazil. Imported aluminum products from Argentina and Brazil are subject to quotas that prohibit any imports above the quota levels.

Product-based exclusions from the Section 232 steel and aluminum tariffs are available on a case-by-case basis, as determined according to criteria defined and administered by DoC.

What about the investigation into the national security threat posed by imported automobiles and auto parts?

On May 23, Secretary Ross again initiated, on his own, a Section 232 investigation into the effect of automobile imports on the national security of the United States, including imported SUVs, vans, and light trucks and automotive parts.

What does Senate Finance Committee Chairman Orrin Hatch (R-Utah) think?

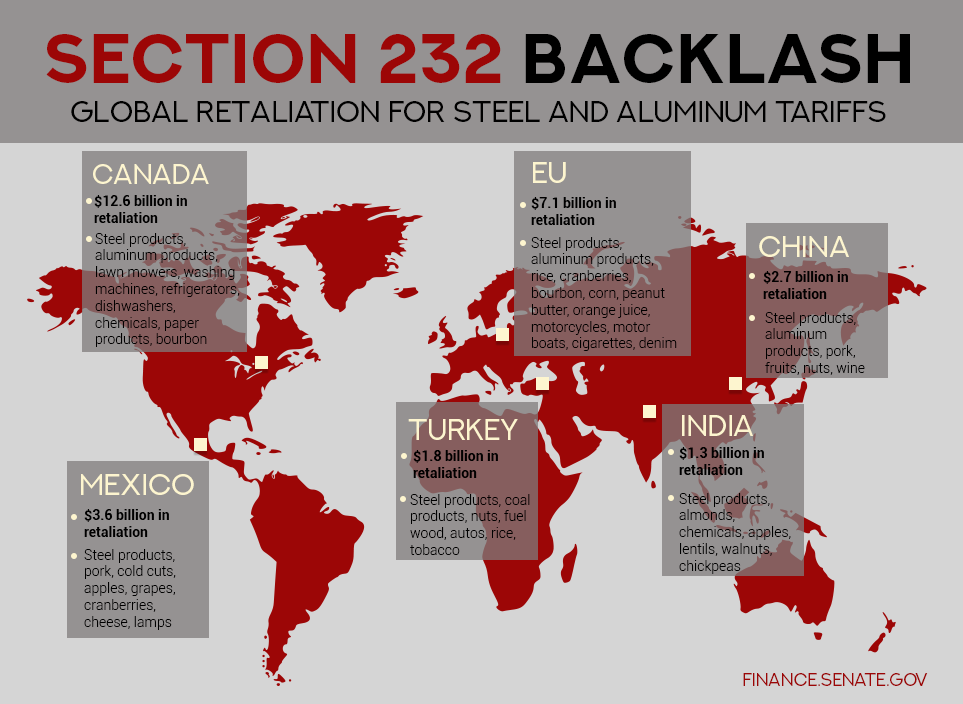

In March 2018, Hatch expressed disappointment with the administration’s announcement of new tariffs on steel and aluminum imports under Section 232, and he has raised concerns with DoC's product exclusion process for steel and aluminum products. Hatch also called the Section 232 investigation into imports of automobiles, trucks and automotive parts deeply misguided. And most recently, Hatch expressed frustration with the administration’s decision to impose tariffs on Americans who import steel and aluminum products from the European Union, Canada and Mexico, which initially were exempted from the Section 232 tariffs.

Other fast facts about these current investigations and resulting trade restrictions:

-

American importers are required to pay tariffs, not foreign governments or foreign businesses.

-

June 1 was the end date for initial temporary exemptions that the president granted for steel and aluminum products imported from the European Union, Canada and Mexico.

-

President Trump authorized Secretary Ross to grant product-based exclusions from the Section 232 tariffs for steel and aluminum products that are determined “not to be produced in the United States in a sufficient and reasonably available amount or of a satisfactory quality” or based upon specific national security considerations. DoC has indicated that it will refuse to grant any exclusions for steel and aluminum products that would be imported from countries that are subject to quotas, irrespective of whether the product is produced in the United States and irrespective of any national security considerations.

-

Any individual or organization in the United States may file objections to product exclusion requests.

The bottom line:

It’s been more than 15 years since DoC performed a Section 232 investigation into whether any imported products threaten to impair the national security of the United States. Congress is taking a closer look at how DoC’s investigations in 2017 and 2018 and the resulting trade restrictions are affecting American interests and stakeholders.

Tomorrow, the Senate Finance Committee – which has jurisdiction over international trade policy – will hold a hearing to further examine Section 232 and opportunities for a better course forward. Be sure to tune in at 9 a.m.

###

Next Article Previous Article