The America’s Healthy Future Act: Cutting Taxes for Americans and Making Insurance More Affordable

According to the Joint Committee on Taxation (JCT), Americans will get an average tax cut of 1.3 percent over ten years as a result of the America’s Healthy Future Act. JCT estimates indicate that the bill’s Health Care Affordability tax credits will reduce taxes for more than 42 million Americans by 2017. Moreover, new limits on out-of-pocket expenses will effectively protect all Americans from the skyrocketing costs of health care today.

Cutting Taxes for More Than 42 Million Americans by 2017: Under the America’s Healthy Future Act, more than 42 million taxpayers will get an average net tax cut by 2017 by an average 1.3 percent with the help of affordability tax credits.

Significant Tax Cuts for Low- and Middle-Income Americans: Based on JCT estimates, all taxpayers earning up to $75,000 will, on average, receive a tax cut under the America’s Healthy Future Act by 2017. Low and middle income taxpayers, in particular, will receive a significant tax cut. Taxpayers earning between $20,000 and $30,000 will see an average federal tax decrease of 38.4 percent in 2017.

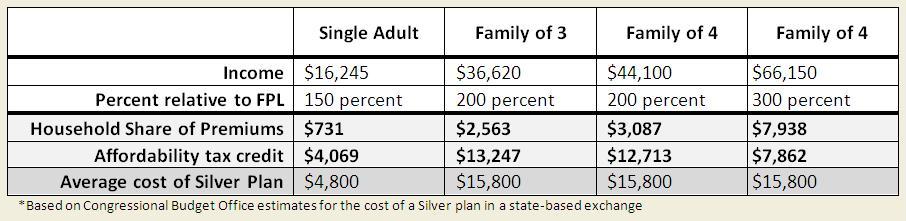

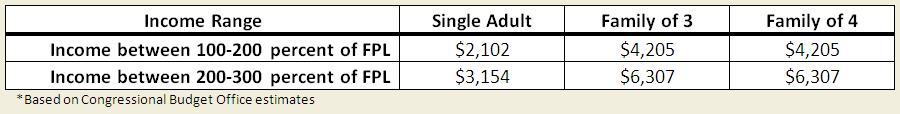

Providing Tax Cuts to Make Premiums More Affordable: Over the next 10 years, the America’s Healthy Future Act will provide $463 billion in tax cuts to make health insurance premiums more affordable for low and middle income taxpayers and their families. Americans earning between 100 percent and 400 percent of the federal poverty level (FPL) will be eligible to receive tax credits calculated based on family-size and income. The America’s Healthy Future Act would also limit out-of-pocket expenses based on family size and income.

Affordability Tax Credits to Purchase Insurance in an Exchange

(Click to Enlarge)

Out-of-Pocket Limits for Insurance Purchased in an Exchange

(Click to Enlarge)

###

Next Article Previous Article